All Articles about Energy

The Hamburg-based power trader, direct marketer, and power supplier CFP FlexPower has founded an independent subsidiary to expand the development and operation of grid-connected large battery storage systems in Germany. The new company, FlexPower Energy, focuses on providing energy storage systems rated between two and 50 megawatts of power.

Germany has reached a record level in the installation of solar systems with 15 GW in 2023. However, problems are now beginning to emerge with rooftop solar.

The FlexIndex measures on a daily basis the revenues that operators of flexible assets can achieve in Germany’s short-term spot market. The index is based on a reference battery with a storage capacity of one megawatt-hour and a power of one megawatt.

In recent years, if you’re involved in the power sector, you’ve likely come across discussions about Power Purchase Agreements (PPAs). Some consider them a cure-all for advancing the energy transition, and we, too, recognize their crucial role. However, it’s essential to grasp that a PPA is essentially a contract for buying or selling power, without specifying the type.

We are often asked how the financial optimization (or: arbitrage) of a battery across the different market places of the spot market works. We show this x-market optimization here by way of example focusing on the day-ahead spot market (hourly auction at 12 noon), intraday quarter-hourly auction (at 3 p.m.) and the so-called intraday continuous market (quarter-hourly products up to five minutes before delivery).

17 German power traders for renewable energies, who place well over 45 gigawatts of solar and wind power on the power exchanges every day, fear negative effects on the market integration of renewable energies due to the current legislative proposal for the new German Energy Industry Act.

After an extensive test phase, Hamburg-based power trader FLEXPOWER has launched a self-developed platform for the conclusion of Power Purchase Agreements (PPAs). On PowerMatch, power consumers and power producers can now view prices for the purchase or sale of renewable energy power live and in a transparent way.

or: how transparent and efficient renewables pricing is the next step of the energy transition.

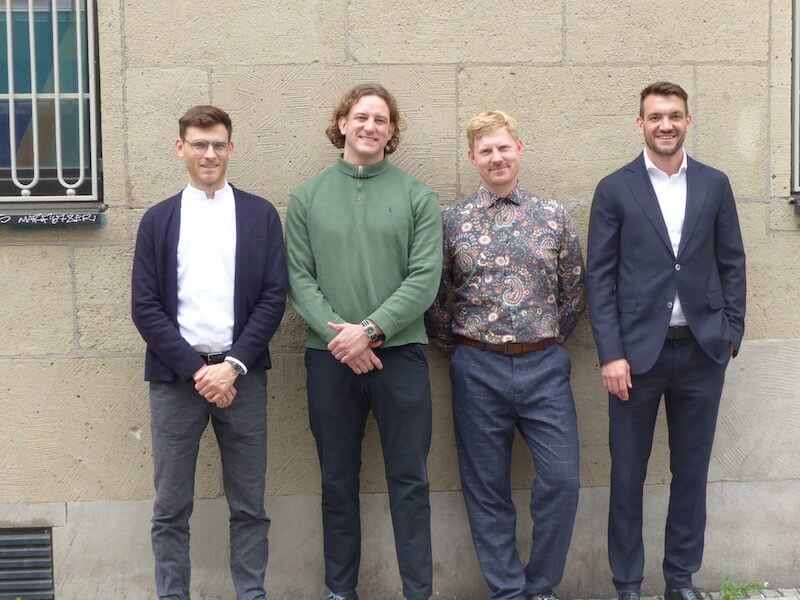

CF Flex Power GmbH (“FLEXPOWER”) is a new trader entering the European electricity market. The Hamburg-based power trader focuses on the market integration of renewable energies and the potential of stationary battery storage to provide flexibility for the electricity market.

The German government plans to introduce a price cap (essentially a tax) for energy producers. This will likely lead to the curtailment of valuable green energy production at times of positive prices (worst case). Best case it will introduce a minimum price floor in markets exactly at the level of the marginal tax rate.