THE GERMAN GOVERNMENT PLANS TO INTRODUCE A PRICE CAP (ESSENTIALLY A TAX) FOR ENERGY PRODUCERS. THIS WILL LIKELY LEAD TO THE CURTAILMENT OF VALUABLE GREEN ENERGY PRODUCTION AT TIMES OF POSITIVE PRICES (WORST CASE). BEST CASE IT WILL INTRODUCE A MINIMUM PRICE FLOOR IN MARKETS EXACTLY AT THE LEVEL OF THE MARGINAL TAX RATE.

The Tax Problem

This sounds a bit complicated so let me break it down. The basic idea here for an energy producer is quite simple: whenever my expected tax payment is greater than my revenue from selling my product, I would rather not sell and avoid the tax. Renewable plants (this is true for all producers but in this blog post, I will stick to renewables) will simply shut down ("curtail") their production when prices drop below their anticipated tax rate.

Starting in the Past: How the Renewable Subsidy worked

Let’s take a step back into the past to illustrate the point from the opposite angle: before the energy crisis and the currently high price levels, renewables were benefitting from a price floor. We assume a price floor (feed in tariff / anzulegender Wert) of 120 EUR/MWh (12 ct/kWh) and a Reference Market Value, against which the subsidy is calculated of 30 EUR/MWh (this was the average Spot price level in 2020). The subsidy in this case would be calculated as

Price Floor – Reference Market Value = 120 EUR/MWh – 30 EUR/MWh = 90 EUR/MWh

So, if the actual Spot price in an hour is exactly 30 EUR/MWh, the plant receives

Spot price + Subsidy = 30 EUR/MWh + 90 EUR/MWh which is exactly its price floor of 120 EUR/MWh

(For the experts: I am ignoring trading companies/Direktvermarkter in this discussion whilst pretending that the asset owner and the trader are the same entity. This reduces complexity, however the main important points remain exactly the same).

Why Subsidies led to Production at Negative Prices

So, what happened, when prices turned negative i.e., the market signals that there is too much production? Say we have a Spot price of -20 EUR/MWh. Now the asset owner receives -20 EUR/MWh+ 90 EUR/MWh = 70 EUR/MWh. Thus, they’re still better off producing than shutting down and they keep producing. This changes when market prices drop below the (negative) subsidy level i.e., -90 EUR/MWh. Say prices are at -100 EUR/ MWh. Now the asset owner receives -100 EUR/MWh + 90 EUR/MWh = -10 EUR/MWh. This is no fun, so the asset owner would rather choose curtailment and shut down production. And that is exactly what they did. Figure 1 show Spot Prices in 2020 and one can see that prices never really dropped below -90 EUR MWh, because renewables would be shutting down production at this point and thereby prices could never really fall below the -90EUR/MWh mark.

Day Ahead Spot Prices in 2020

How a Subsidy Free market behaves rationally: No Interference; Production only at Positive Prices

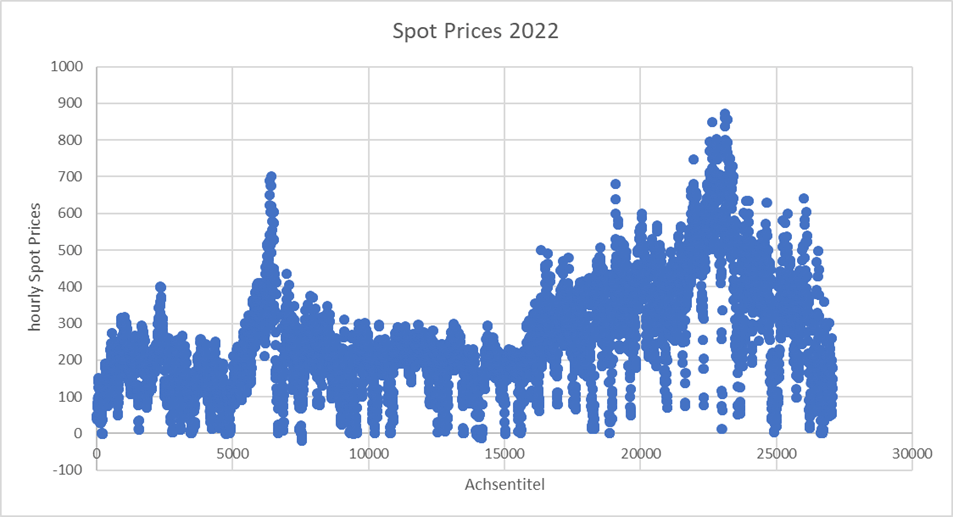

Let’s move into 2022, when the price level increased a lot (I am using data until October and and up to this point we see an annual average of 238 EUR/MWh). See Figure 2:

Price levels 2018-2022

The calculation in 2022 changes:

Subsidy = Reference Market Value – Price Floor i.e. 120 EUR/MWh – 238 EUR/MWh = -118 EUR/MWh

This would be a negative value, and if Germany had a contract for difference (CfD), it would be the amount that the plant owner now needs to pay back. However, Germany does not have this system, so the subsidy simply decreases to zero. The question is what happened to the effective shut down price of the asset? You guessed it: it is at the same level of the subsidy i.e. exactly zero. When there is no subsidy, producers stop operating when they no longer receive revenue for their production.

Figure 3 shows the spot prices in 2022 and it is exactly as expected: there is a hard price floor at 0 EUR/MWh as production simply stops at this point just as it did at -90 EUR/MWh in 2020. Markets working like a charm; this should put a little smile on every economist’s face.

Day Ahead Spot Prices 2022

Turning to 2023: Introducing Price Caps

However, this brings us to the real question: what happens when production is not only subsidized at low prices but when “windfall profits” are taxed away at high prices. Imagine a situation in which government introduces a rule saying that all revenues above the guaranteed price floor of 120 EUR/MWh + a safety margin of 30 EUR/MWh + an anticipated management fee of 4 % of the Spot price would be taxed away and imagine further that January 2023 was trading at 300 EUR/MWh (which it is). The price cap for our asset would be set at

120 EUR/MWh + 30 EUR/MWh+0.04*300 EUR/MWh = 162 EUR/MWh

Jumping into the future, say January 3rd at 11am, we assume that power is trading at exactly 300 EUR/MWh. The asset owner will now pay

Tax = Reference Market Value – Price Cap = 300 EUR - 162 EUR/MWh = 138 EUR/MWh

The owner receives

Income = Market Price - Tax = 162 EUR/MWh

Essentially this is a backdoor CfD (Contract for Difference).

How Taxes turn into Wasted (Curtailed) Energy

Now let us jump back a bit to January 1st at 6am: everyone above 40 years of age is asleep, and it’s very windy outside: power prices drop to 120 EUR/MWh…, or can they?

At 120 EUR/MWh our asset owner will make 120 EUR/MWh in income and pay 138 EUR/MWh in tax. Profit = -18 EUR/MWh. As our asset owner trader does not enjoy losing money, they will rather shut down production and curtail the renewables asset. For 2023, simply imagine the 2022 graph pushed up from 0 to around 132 EUR. Why is this bad? Well, if the asset owner kept running, she would have made a negative return of -18 EUR/MWh. However, the government/DSO/society would have been paid 138 EUR i.e. there would have been a social welfare/value of running the plant of 138 EUR/MWh-18 EUR/MWh = 120 EUR/MWh. Therefore, the tax structure is giving the asset owner an incentive to waste 120 EUR of social welfare. Or to press this point harder: in the midst of an energy and climate crisis, we would be throwing valuable renewable energy into the garbage.

Figure 4 shows the values as I outlined them in this example:

2020 | 2022 | 2023 | ||

|---|---|---|---|---|

Reference Market Price for Subsidy / Tax | 30 | 238 | 300 | |

Price Floor / Guaranteed Feed in Tarif | 120 | 120 | 120 | |

Price Cap | = guaranteed feed in Tarif + 30 EUR + 4% reference Market price | 162 | ||

Subsidy | max = (0, reference market price - price cap) | 0 | 0 | |

Tax | max = (0, reference market price - price cap) |

|

| 138 |

Shut down Price | 90 | 0 | 138 |

Figure 5 shows the optimal shut down price for the described asset at various reference market price levels:

Shut Down Prices in Relation to Reference Markt Values

Shifting Reference Market Prices only helps a little

Obviously, the government knows this and will try some voodoo to lower the tax rate in times of low prices to avoid curtailment. However, the can is then only kicked down the road. If they use the hourly Spot price, instead of a monthly reference market as the Reference Market Value, we will see exactly the same effect that I have described above on the Intraday market rather than the Spot market. Only that our new Reference Market Value becomes the hourly Spot price instead of a monthly average.

Trying to keep Reference Market Values close to Real Time Prices may alleviate the Waste and avoid Curtailment

If everyone had the same subsidy scheme, the same incentives, and the same ability to react to incentives, I believe that the fact of positive shut down values would not be dramatic, as it would probably just push up minimum price levels in relation to the Reference Market Value. But there are multiple subsidy schemes and levels, various actors, and very different abilities to react to incentives, which will lead to a situation in which valuable power will be thrown away because of a tax on power in times of an energy crisis. There are no simple fixes to this problem.

However it is very clear that this problem becomes worse as the Reference Market Value against which the tax/subsidy is calculated moves further away from real market prices. Taking the average price over a year as reference would be terrible, against a month would be very bad and against hourly Spot would probably be the best one can do, as this only leaves the problem between hourly Spot and quarter hourly intraday.

Once again, we wish the regulators good luck with this issue and deeply hope that they do not force traders’ hands in curtailing valuable and green power. We would like to keep them running.