DIRECT MARKETING CONTRACTS IN GERMANY ARE TRADITIONALLY SETTLED AGAINST SO-CALLED REFERENCE MARKET PRICES. WE BELIEVE THAT THIS IS AN OUTDATED APPROACH WHICH INCREASES UNCERTAINTY AND THEREBY LOWERS THE INCOME OF RENEWABLE PRODUCERS.

REFERENCE MARKET PRICE SETTLEMENT

A direct marketing (Direktvermarktung) contract traditionally works as follows: An energy producer, say a wind farm, signs with a trading company to trade their power. For each MWh produced the trading company agrees to pay the producer some index price, depending on the time at which power is produced and receives a management fee for this service.

This index price tended to be the so-called reference market value (RMV). This value is published by the grid providers and is defined as the average power price that a certain asset class (such as onshore wind) has received for its production over the course of a month. This made (some) sense in times when power prices were below the guaranteed price-floor of such an asset. For instance, in October 2020 the average spot day ahead price was 34 EUR/MWh and the RMV was at 30 EUR/MWh. Renewables tend to make a bit less than the spot price, because when they run, prices drop, so this is just simple supply and demand (see Hirth 2014). Let’s say our asset had a price floor (anzulegender Wert) of 90 EUR/MWh. Now the producer would receive 30 EUR/MWh from the trading company and another 60 EUR from the grid provider, making sure she receives the guaranteed price of 90 EUR/MWh. Banks like this, because – on the surface- it means fixed returns and little risk.

Structure Costs

However now assume, as is almost always the case, that our asset does not produce power exactly at the same time as the average on-shore wind farm. Our hypothetical wind farm is in the north east of Germany and tends to produce power when there is lots of wind. So on average its production is worth 28 EUR/MWh instead of the average 30 EUR/MWh. The trading company will analyze this fact in advance and incorporate this into its management structure fee. Let’s call these 2 EUR/MWh structure costs. Since the trader only expects to make 28 EUR/MWh on Spot while they need to pay out 30 EUR it will charge these 2 EUR/MWh plus an uncertainty margin of say 20% i.e. 2.4 EUR/MWh as management fee for structure costs.

Balancing Costs

Now the job of the trading company is a bit more complex than just selling the power at spot prices as it faces additional risks. It forecasts the production of the asset and sells this forecast on the hourly Day Ahead auction. However, there is always a forecast error, i.e., a delta between the forecast and the real production. The trader (or his meteorologists) will make better forecasts during the day as the data improves as we are closer to delivery on each quarter hour of the day. He will buy/sell the difference between the Day Ahead forecast and his Intraday forecast on the continuous Intraday market. But as his Intraday forecast is also imperfect he will need to pay (usually expensive) balancing energy prices for the difference between his final forecast and the real production. These are the so-called balancing costs and according to our analysis they usually range at around 4% of spot prices. So, at a price level of 34 EUR this would be an additional balancing cost of 1.7 EUR + 20% uncertainty margin i.e. 2.1 EUR/MWh. So, our final fee in this setup is 2.1 EUR + 2.4 EUR = 4.5 EUR/MWh. The producer receives RMV+Subsidy-Management Fee = 30 EUR + 60 EUR – 4.5 EUR = 85.5 EUR.

RENEWABLES TRADING IN TIMES OF HIGH PRICES

Moving to the times of the current energy crisis the picture changes. Say the contract in our example runs from 2021 – 2024 taking the price level of July 2022 where the average Day Ahead Spot price moves to 315 EUR and the Reference Market Value of Wind was at 278 EUR. Let us assume our asset still underperformed the average wind plant by the same ratio as in 2020. It now receives an average price of 260 EUR/MWh i.e., 18 EUR less than the RMV. Balancing costs have also increased to 4% of Spot base prices, i.e. to 12.6 EUR/MWh. So, the trading company now has a cost of 30.6 EUR against a fee revenue of 4.5 EUR. Just to give you some idea on the scale of this mess for the trading company: Assuming annual production of 175 GWh for a 100 MW windfarm; they are looking at revenues of 0.8 Million against trading costs of 5.4 million or at a loss of 4.6 million EUR on a rather small wind portfolio. The producer on the other hand would be looking to make a revenue = RMV-Fee (note that there is no more subsidy because the RMV is above the price floor), i.e. 260 EUR – 4.5 EUR = 255.5 EUR. So, she is making 255.5 EUR instead of the expected 85.5 EUR. With an assumed annual production of 175 GWh, she makes 44.8 million instead of the anticipated 15 million. Doesn’t take much to figure out who is winning on this deal.

WHY NO ONE IS SHOWING PRICES

With futures contracts trading at around 400 EUR/MWh for the year 2023 it becomes apparent why trading firms are very reluctant to offer their services at fixed prices. The risk of high balancing and high structure costs can bankrupt any firm with a reasonably large portfolio.

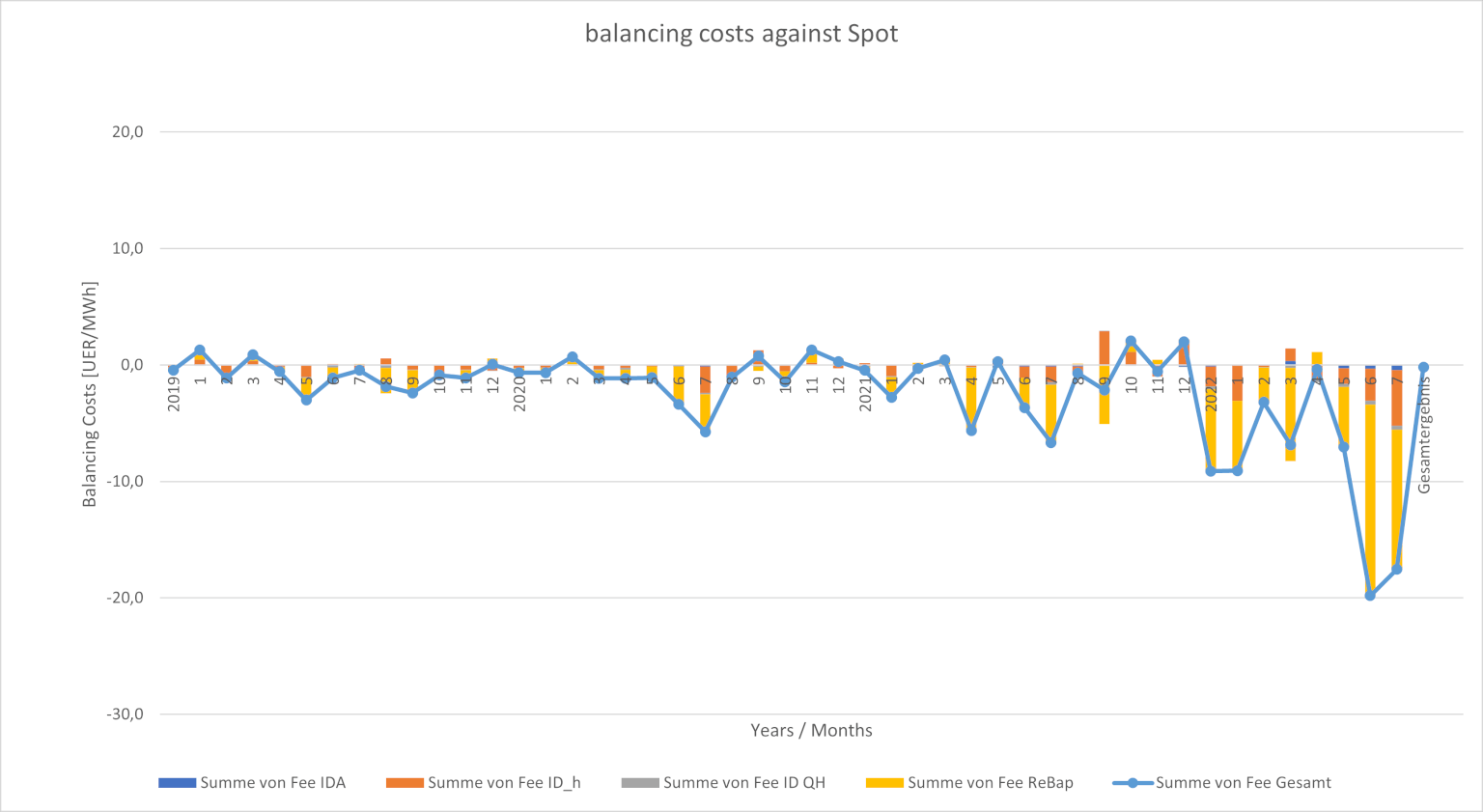

The following chart shows the historical monthly balancing costs of a random wind asset I have looked at against spot prices:

Balancing costs are split up into profile costs (blue), Intraday trading costs (orange and grey) and imbalance costs (yellow). One can easily see how these costs have increased and become a lot more volatile in the recent months.

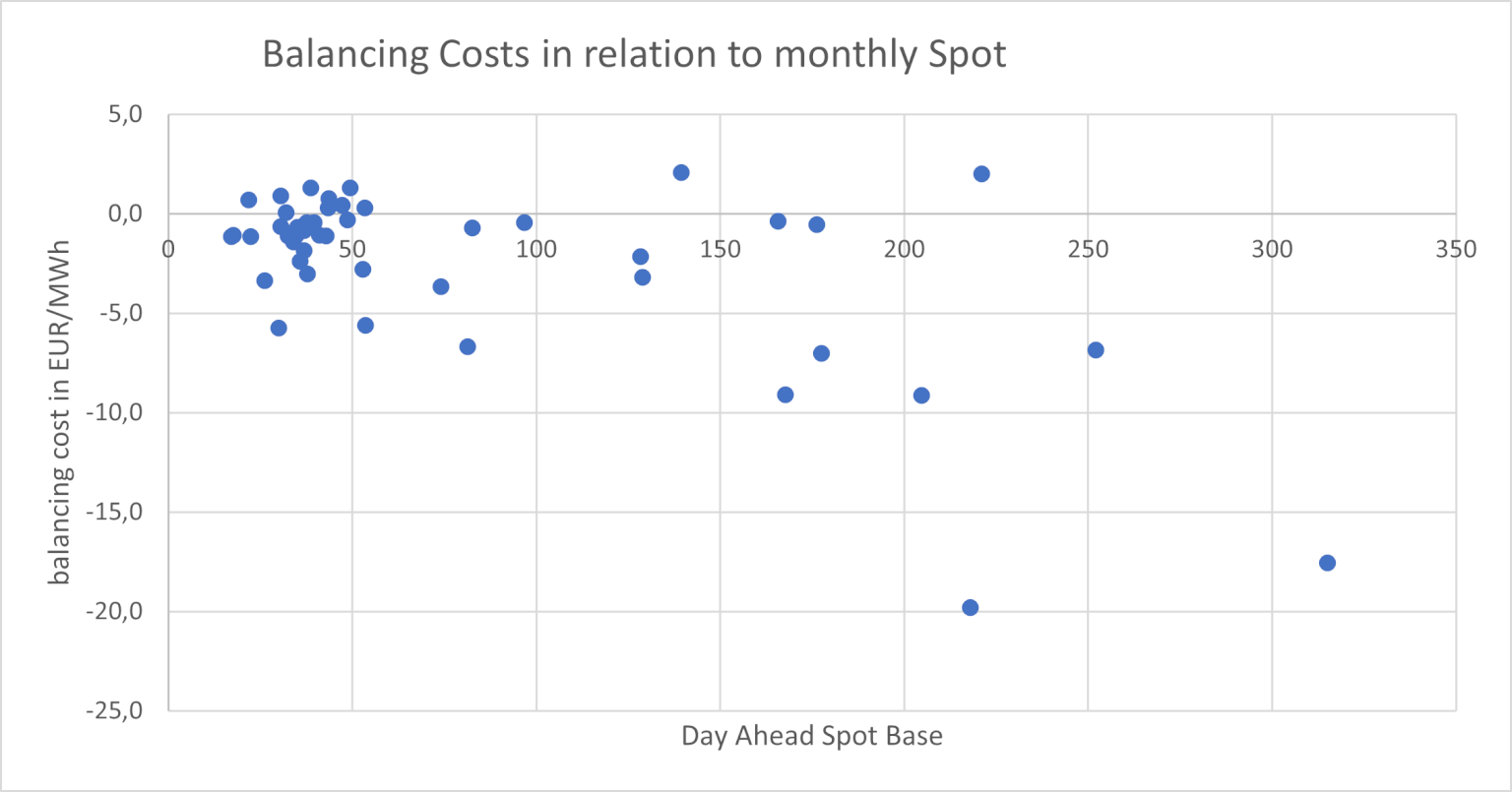

Plotting these costs against average monthly spot prices helps illustrate this fact even more clearly. Balancing costs clearly correlate with spot price levels:

This point is intuitively grasped by anyone who has ever traded Renewables on Intraday markets: When prices don’t fluctuate between 20 EUR to 40 EUR as they did in the past but between 200 EUR and 400 EUR, trading a Renewable position is vastly more difficult and costly.

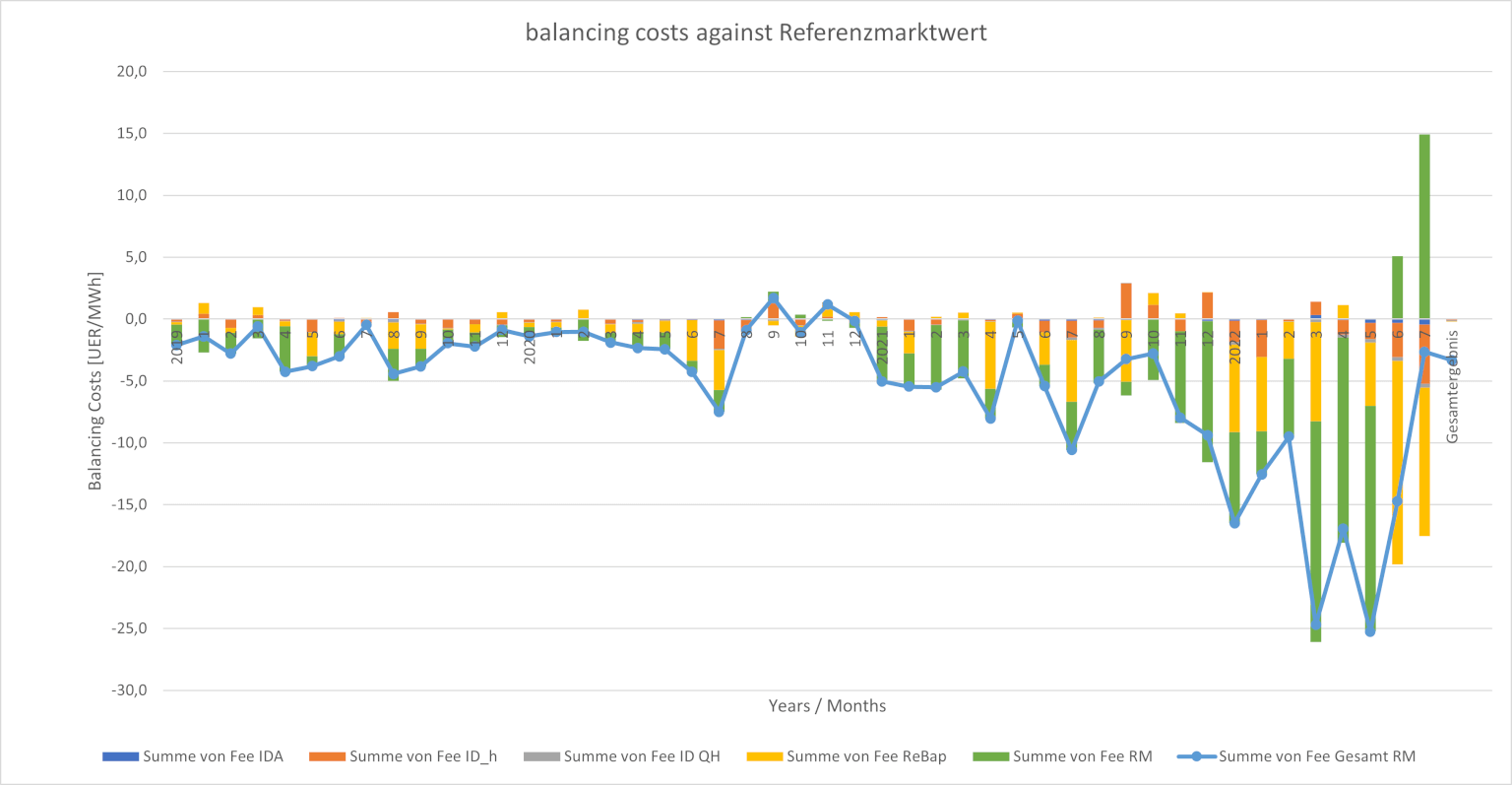

However, for the trader this becomes even trickier when we include structure costs i.e. the difference between the spot price and the reference market value (RMV). Now the total costs (balancing + structure) look like this:

One can easily see that the inclusion of price risks between the spot prices and reference market prices radically increases the volatility in costs, which makes it nearly impossible for the trading company to calculate a reasonable management fee.

HOW TO SHOW PRICES

Let’s say I was to give out a price for a wind farm that historically had balancing costs at around 4% of spot prices and a 6% discount against reference market values, I would calculate a fee as follows:

balancing = current future * 0.04 = 400 EUR * 0.04 = 16 EUR / MWh

structure = current future price *0.06 = 24 EUR / MWh

I would want to put a 20% uncertainty margin around this, as prices may rise unexpectedly, so I am at (16 EUR + 24 EUR) *1.2 = 48 EUR / MWh. This is a lot. And it doesn’t need to be.

The balancing part of the fee is justified and should stay with the trading company as this is risk they can influence through good trading: They can make better forecasts and trade the power on Intraday in a sophisticated way to secure good prices. However, the structure costs i.e. the systematic difference between the asset’s realized spot prices and the reference market value is fully determined by the location of the asset and there is nothing the trader can do about. The reference market value becomes obsolete as an arbitrary index in a high price environment as a guarantor of steady revenues because the producer’s return will likely not depend on their price floor for revenues. The producers are exposed to (high) prices anyway. Therefore, we believe that this part of price risk (structure) should be taken by the producer and not by the trader. The producer is covered in case of a high price scenario anyway. She has high revenues to look forward to (note that I ignore the upcoming price cap in this discussion as it would lead to excessive complexity). Also she will make more money on average if she chooses to carry the structure risk, as the trader will always charge a risk premium on their fees for taking this risk. Therefore, the producer is simply locking in lower returns by forcing the trader to take the structure risk that he does not actually want because he cannot influence it.

The deal for the producers would be even better if they did not only drop their desire to receive the arbitrary reference market value but also agreed to pay the trader a variable fee dependent on spot prices. We would love to make you a deal in which we offer x% of settled monthly spot prices as a fee. If spot prices should fall back to normal levels, the producer would pay a low fee and go back to its price-floor revenues. If spot prices are very high, the producer receives high revenues which can easily be used to pay the relatively higher fees.

We realize that producers like fixed prices, which is why we still offer them. However, only against spot and not against reference market values. These are a relic from the subsidy driven times of the energy transition that we are proud to leave behind. So join us in this new world of trading. We keep saying “the times of produce and forget are over” and we need to arrive at solutions that allocate risks where they are best dealt with.

If you are interested to learn more about this, check our Renewables Trading Offer for 2023.