THE PENDING PRICE CAP FOR RENEWABLE ASSETS IS A REASONABLE IDEA, HOWEVER, IT CREATES EXTREME UNCERTAINTY AND PARALYZES THE MARKET. IF EXECUTED BADLY, IT COULD BANKRUPT HEDGED RENEWABLE ASSET OWNERS.

EXTREME ENERGY WINDFALL PROFITS CALL FOR A TAX

The EU has agreed on infra-marginal price caps for 2023 that are especially targeted on renewable asset holders, who are currently experiencing unforeseen windfall profits for their generated electricity. The German subsidy scheme, the so-called floating market premium was (with the cozy knowledge of hindsight) ill-conceived as a one-sided price floor without introducing a Contract for Difference (CfD) that could have included a revenue ceiling in case of unexpectedly high market prices, as we are seeing right now.

To put some flesh on this point, let us assume a 1 MW asset with a subsidy guarantee (price floor) of 100 EUR/MWh. To keep it simple, our asset produces baseload power throughout the year for 8,760 hours totaling a power production of 8,760 MWh/a. In a normal year, let’s take 2019, electricity spot prices were around 38 EUR/MWh on average, which means that the price floor would have kicked in and our asset would have made revenues of 100 EUR/MWh*8,760 MWhs = 876,000 EUR. Looking at current future prices for 2023 (at the time of writing prices are at ~500 EUR/MWh), our asset would be looking to make 4.38 Mio Euros, which is net windfall of 3.5 Mio EUR. Now a normal windmill produces only 20% of the time at full scale, which means a small 1 MW single windmill is looking at additional revenues, which can be assumed to be pure profits, of roughly 800k EUR. That is a profit increase of 500% and everyone with a sense of equality and justice should understand that government wants a piece of the cake to redistribute it to hard hit consumers and industry. So far so good.

HEDGING POWER PRODUCTION AT HIGH PRICES TO LOCK-IN WINDFALL PROFITS

Now before introducing our government intervention, let us assume that our asset owner would like to lock in these high expected returns for 2023 right now, as she does not like the possibility of energy prices falling in 2023. This would be a classic hedging deal with a futures contract. Basically, the asset owner finds a counterparty, for instance an energy trading company, who will do a futures contract for say 400 EUR/ MWh (as the trading company keeps a juicy margin for itself). This contract settles against the spot price. Such a futures contract is a purely financial and legally independent instrument which pays out the difference between spot prices and the price of the futures contract to ensure that the asset owner always ends up with 400 EUR/MWh regardless of where spot prices settle.

This means that if the spot price is at 300 EUR, the futures contract pays the asset owner 400 EUR- 300 EUR = 100 EUR. If the spot price settles at 500 EUR, the asset owner must pay out 400 EUR – 500 EUR = – 100 EUR against the futures contract. This is what traders would call a hedge against falling prices. The asset owner would always make 400 EUR/MWh or 3.5 Mio/a irrespective of spot prices. (In the now unlikely case of spot prices falling below 100 EUR/MWh she would even make a little more as she would benefit from the government guarantee and have the hedge pay out on top.) Many renewable asset owners have been making these deals over the last months trying to lock in their windfall profits for 2023 and are now well-hedged for the year to come. The Teslas can be bought, or at least, that’s what many of them thought…

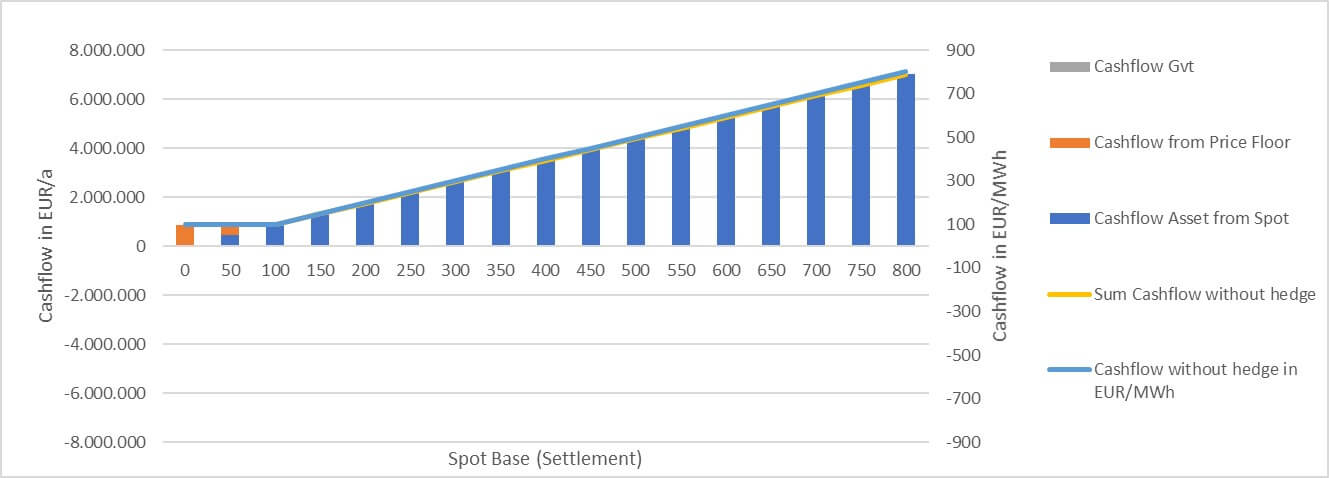

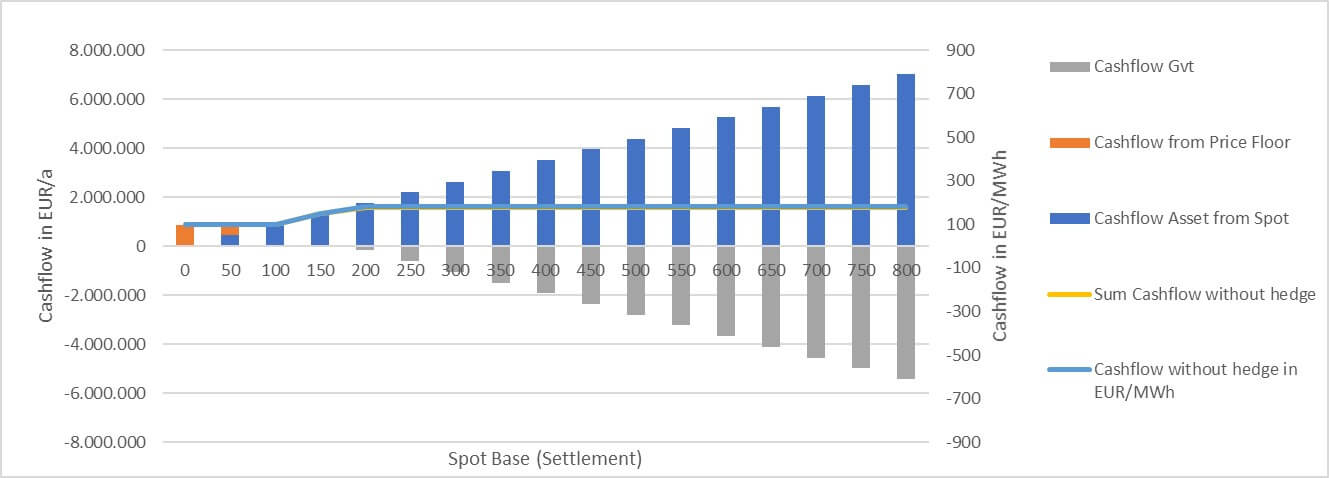

INTRODUCING THE WINDFALL TAX THROUGH A PRICE CAP / REVENUE CAP

However, enter the regulator / party pooper who is showing up to have a piece of the cake. Running with current information, government is planning to introduce a price cap of around 180 EUR/MWhs and tax away the rest. How exactly they want to do this is unclear, but let us assume, they do it straightforward and simply take away any excess profits arising between settled spot prices and their cap of 180 EUR/MWh. We first consider the more common and simple case, in which our asset holder has NOT hedged their position. The asset holder’s revenues are now capped at 180 EUR/MWh or 1.6 Mio EUR/a, which is still a nice sum compared to the initially expected 880k EUR. At a price level of 500 EUR for 2023 she would make 4.4 Mio in spot revenues, pay a tax of 2.8 Mio and be left with (you guessed it) 1.6 Mio EUR.

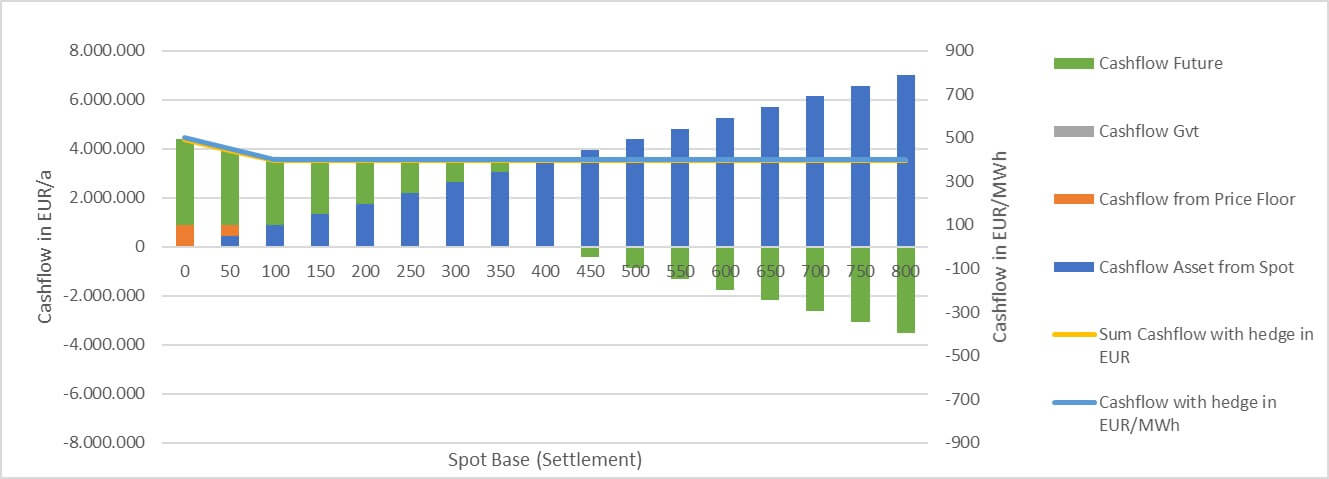

THE PRICE CAP IN COMBINATION WITH A HEDGED POSITION – ADDING COMPLEXITY

Now it is time to add complexity to the mix and return to the case in which the asset holder has hedged her power production for 2023 with a futures contract. Government has not yet indicated how they will treat this case, and we will show you why it is such a tricky question. Let us assume that government simply ignores the fact that the asset holder has hedged the position at 400 EUR/MWh. They could easily argue this, as this is a purely financial contract that was done at the risk of the asset owner.

The futures contract of our asset holder is unaffected by the government price cap and still pays out in the same logic. This means, that at a price of 300 EUR the asset owner receives 100 EUR/MWh and at a price of 500 EUR, the asset owner has to pay out 100 EUR/MWh. Now let us have a closer look at the situation in which prices are at 300 EUR. The asset owner makes 2.6 Mio in spot revenues. She has to pay 1 Mio to the government and receives 0.9 Mio EUR payout from the hedge. This leaves her at 2.5 Mio which is better than the 1.6 Mio, she would have made without the hedge. Therefore, if prices are below the futures contract, and government does not care about this contract, the asset owner still makes a return of 280 EUR/MWh instead of the capped 180 EUR/MWh. We learn: if prices fall, and government ignores the hedge, we would like to be hedged.

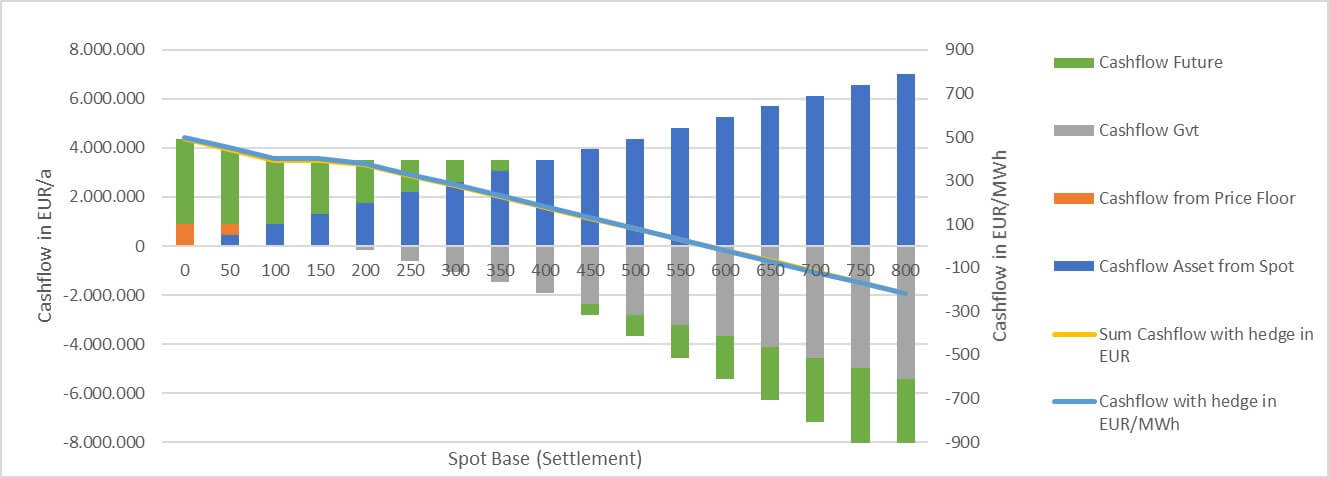

THE RISK OF BANKRUPTING HEDGED RENEWABLE ASSET OWNERS AT HIGH SPOT PRICES

This situation looks much bleaker if spot prices rise above the hedged price of the futures contract of 400 EUR. Assume prices are at 500 EUR. The asset owner makes 4.4 Mio in spot revenues and pays out 2.8 Mio to the government. On top of this she must pay 0.9 Mio against the futures contract. this leaves her at a revenue of 700k EUR while she would have made 1.6 Mio without the hedge. Her price per MWh decreases to 80 EUR/MWh which is below the floor price of 100 EUR/MWh. To make this a bit more extreme, let us say prices settle at 600 EUR, which is high but not unrealistic given that we have seen future prices at 1,000 EUR a few weeks ago. Now she makes 5.3 Mio in spot revenues and pays 3.7 Mio to the government. In addition, she pays 1.8 Mio against the hedge, leaving her at a net payout -200k. This would translate into a negative price of -20 EUR/MWh. This is significantly worse than in the unhedged situation in which she would have made 180 EUR/MWh, and it does not take much imagination to see how countless renewable asset owner would quickly be insolvent in this situation.

TOUGH CHOICES AND POSSIBLE WAYS FORWARD

Given this situation, we are experiencing extreme uncertainty in the market, as asset owners do not know what kind of risk they are facing or even what kind of risk they have committed themselves to by signing futures contracts. Moreover, it is unclear where the tax will be applied. Is it the asset owner or the trading company (Direktvermarkter) that are holding the short end of the stick and might go bust, if they have to pay out large sums against the government and against their futures contracts should energy prices settle above wherever they are hedged?

The straightforward answer out of this mess would be to simply incorporate any futures contracts into any government price cap consideration and apply the tax not against spot prices but rather against the futures position, should such a position exist. However, this is not at all easy to do in practice. Futures contracts cannot clearly be attributed to a specific asset, as they are financial contracts that have a life of their own and in most situations only a part of the production of any given asset is hedged while another part remains exposed to spot prices. Incorporating futures contracts into the mix will be messy and there is simply no easy way out of this. The best way forward, in our view, would be to calculate the energy price cap against spot prices as a default, and then let asset owners prove to the government that they were hedged below settled spot prices in case they are unduly hurt by the tax (e.g. our 600 EUR settlement example). However, this would leave asset owners with additional windfall profits if the price settles below their hedge as they receive payouts above the 180 EUR/MWh (e.g. our 300 EUR settlement example). Leaving this asymmetry would create a big incentive and therefore a rush into futures contracts for 2023 for anyone who has not yet hedged their position. However, this may be a risk worth taking as government still can tax a large chunk of windfall profits without risking to bankrupt part of their renewable asset owners. We do not envy the regulators having to make these decisions, however we do implore them to create clarity and transparency quickly, so that the market can go back to doing its job.