THE GERMAN FLEX STORY – PREDICTING AN INCREASE IN THE VALUE OF FLEXIBILITY

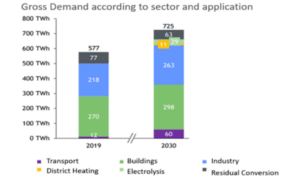

The decarbonization of energy is the largest industrial endeavor of our time. Energy supplies are changing from large, centralized and dispatchable plants to small, decentralized and weather-dependent renewables: mostly wind and solar. Although this is not a new story, the fact still catches the economy and specifically the energy sector off-guard. Figure 1 illustrates power demand increases from the ongoing electrification of transport, industry, and heating. This puts a strain on supply that will be endangering security of supply with the additional challenge of integrating an unforeseen growth of renewable energies.

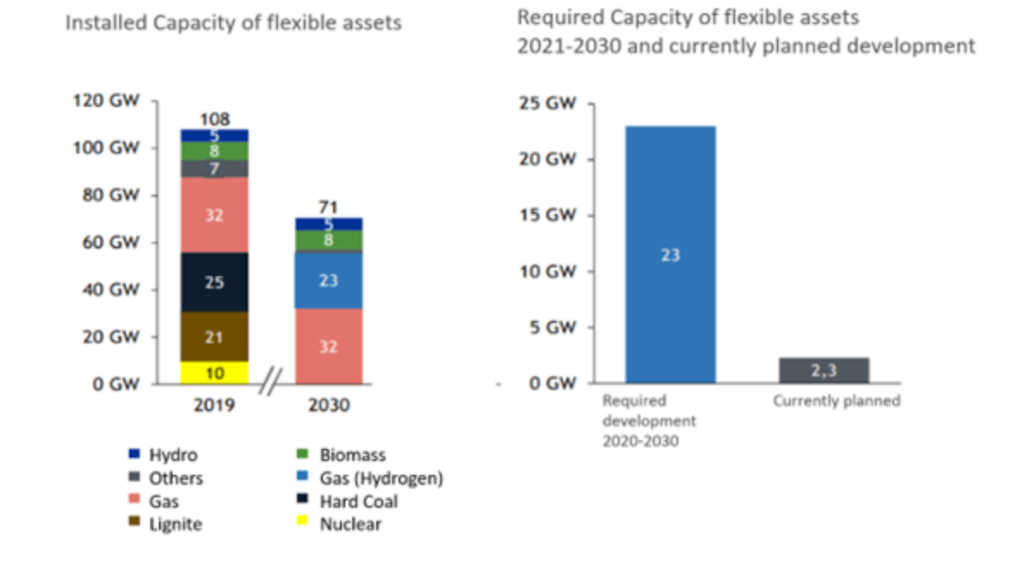

However, not only will demand grow but the supply of reliable baseload (nuclear and lignite) and dispatchable supply (coal and to a lesser degree gas) is rapidly leaving the market: According to current government plans the market is set to phase-out > 45 GW of dispatchable capacity until 2030. The Institute of Energy Economics at the University of Cologne (EWI) quantifies the need for new flexible energy development at an additional 23 GW until 2030, only 2.3 GW of which are currently planned (see Figure 2). This flexibility will consist of demand side management, gas powered plants and grid- as well as home-scale storage (i.e., batteries). While current blocks of coal and nuclear are in the range of units sized 100 MW – 1,000 MW, these new flexibilities are likely to be much smaller and scale from 0.1 MW – 100 MW.

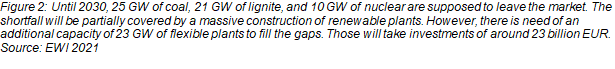

Modeling the energy system into the future is not a straightforward endeavor. However, even considering optimistic asset development plans, Reuter’s model predicts situations with capacity shortfalls of up to 20 GW (equivalent of 20 nuclear power stations) in the year 2030.

![]()

Figure 3 demonstrates that in current business-as usual scenarios, Germany may be facing major power outages. This indicates an extreme and foreseeable shortage of flexibility. While these problems have long been anticipated, the market is already today reflecting the increasing value of flexibility in various forms.

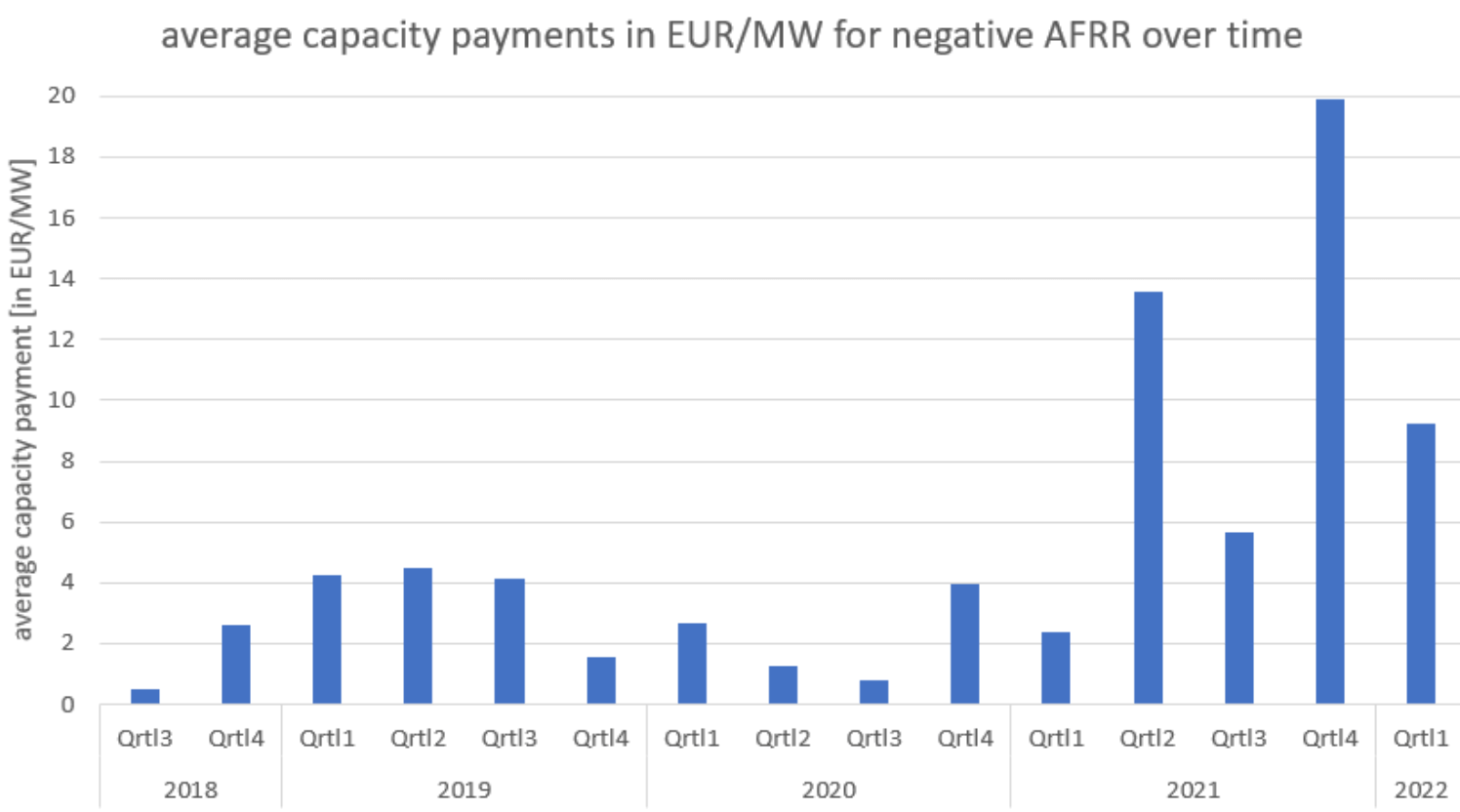

Diving into the details, we can see that capacity prices for negative secondary balancing reserves (AFFR)1 have massively increased in the last year to around 10 EUR/MW, meaning that a battery with a charging potential of 1 MW could make 87,600 EUR/a purely on capacity payments (see Figure 4). At these price levels, grid scale battery storage becomes a competitive asset.

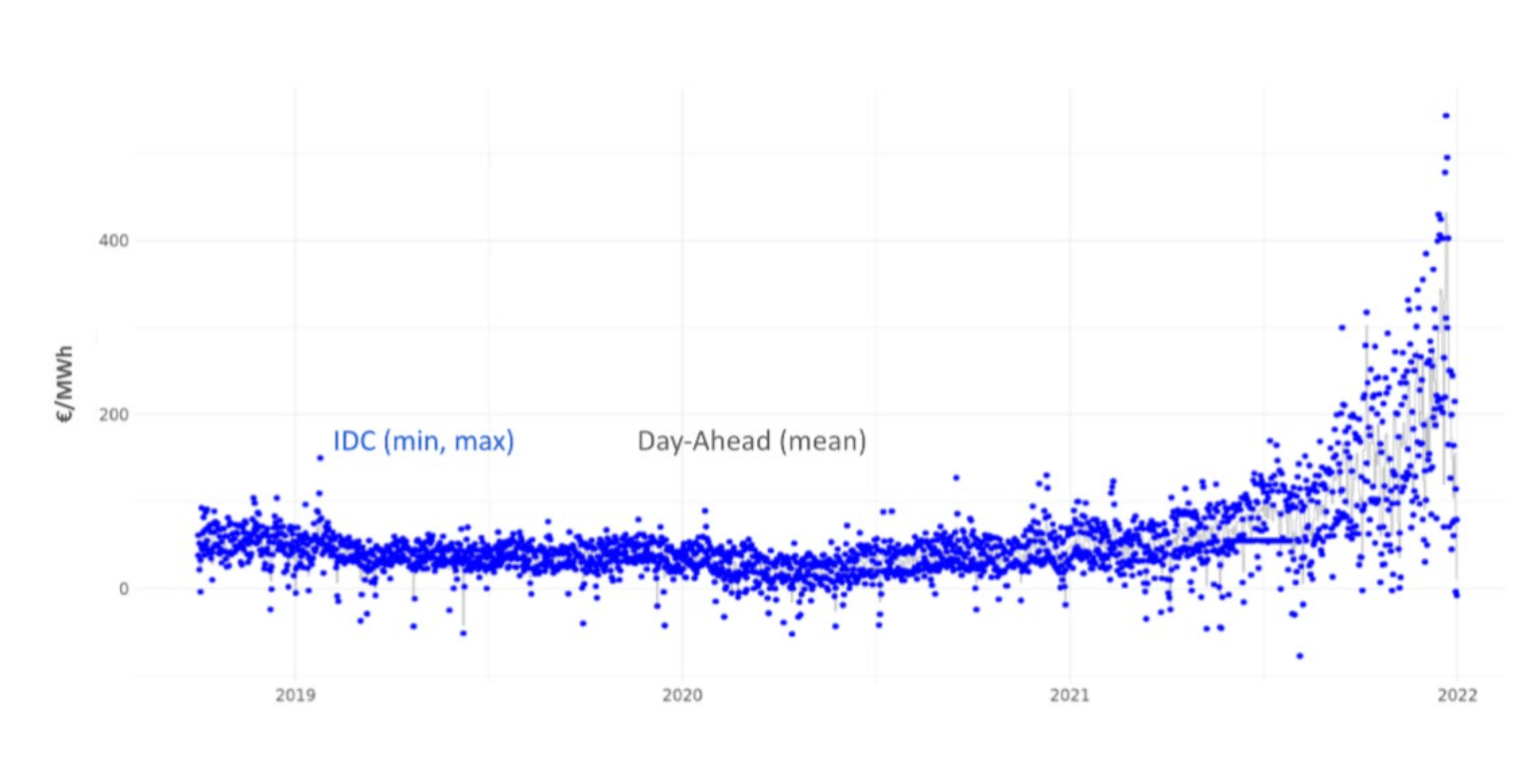

Additionally, price volatility in spot and intraday markets is at unprecedented levels. This is a further indicator for the increase of the value of flexibility as well as the potential for proprietary trading. This trend will further push demand side management, battery storage and gas plants into the money. Figure 5 displays absolute price levels on the day-ahead spot market as well as Min-Max price spreads on intraday markets. Both trading and flexible assets will benefit as these spreads continue to increase.

European power systems are becoming more uncertain, more difficult to plan for, more decentralized, and thereby vastly more complex. Uncertainty generally increases the value of flexibility while volatility makes decisions more costly. Hence, the value of two things is set to increase: The option to choose, and the quality of the choice that is made.