In this subsequent blog, we extend our discussion from part I, titled "Hedging Consumption with Standard Wind and PV Shapes," wherein we explored the future dynamics of purchasing power using standardized enwex Wind and Solar shapes. We recommend to first read the aforementioned article as we continue to elaborate on the foundational concepts established therein.

One of the challenges inherent in hedging consumption with renewables lies in the potential scenario of having your wind and solar production underperform relative to your consumption at times that the system is short as a whole. Consequently, companies may find themselves lacking in power (a short position) precisely when the system is short as a whole necessitating power purchases at high spot prices. Conversely, during periods of surplus, companies may possess an excess of power (a long position), aligning with a surplus in the overall system, thereby requiring sales at low prices. Basically, you are short when power is expensive and long when it is cheap. However, not to worry, we have a fix!

One approach to mitigate this adverse volatility is through investment in assets such as energy storage, exemplified by a battery, which can capitalize on these market dynamics. However, the complexities associated with construction and engineering may present obstacles for companies more adept at power procurement than technical matters. We believe that your capital should be spent on whatever you are best at doing, it is our job to solve your power procurement.

A better strategy than building your own asset is to address this volatility by buying a FlexHL shape, which copies the behavior of a battery in the Day Ahead market. In this context, volatility is measured as the spread i.e. the price difference between the highest and lowest prices observed within a day, with the FlexHL shape structured accordingly. Essentially, the FlexHL shape involves purchasing during the hour with the lowest price and selling during the hour with the highest price, thereby capturing the spread between these price points and thereby offsetting your risk.

How does the FlexHL Shape Product Work in Practice?

Like any power product, we can deliver you the FlexHL shape as a physical or as a financial product. The payout structure is exactly the same, but we will stay physical in this example. In Graph 1 you see the Flex HL schedule on an exemplary day: Hour 14 is the cheapest trading at 39 EUR/MWh and hour 20 is the most expensive trading at 192 EUR/MWh. The FlexHL shape simply delivers you 1 MWh of the most expensive hour and offtakes the cheapest hour. Just like a battery would.

Graph 1

Now let us first have a look how the FlexHL product - i.e. the spread between the cheapest and dearest hour on the German Day ahead market - looked like historically. See Graph 2:

You can see that the FlexHL (i.e. within day volatility) is correlated with the overall price level. When prices are low, the spread between the highest and lowest hour is low, while it tends to increase with higher prices. The FlexHL was highest during the midst of the energy crisis indicating a high earning potential for flexibility. This is not a 1:1 causal relationship, and we expect the FlexHL shape to stay quite high even at lower prices levels, as the increasing amount of renewables tends to increase volatility in the system.

So, let’s assume for a moment that you bought a Flex HL shape for the Cal 2023 at the beginning of the year 2022 and at the then normal price levels. We assume you bought this FlexHL product at a price of 97,88 EUR/MWh.

Now let’s look at a day with little renewable power in the year 2023, when your shape product is live such as December 1st, 2023. On this day we now physically deliver you the FlexHL shape for your fixed price of 97,88 EUR/MWh. However, as you can see in Graph 3, the highest price is 230,69 EUR/MWh and the price for the lowest hour is 98.88 EUR/MWh. The spread between these products is 131,81 EUR/MWh.

Graph 3: FlexHL shape as physical delivery and at a fixed price on December 1st, 2023

As we have delivered the power to you at a fixed price you (or your dear trader FlexPower) can now buy the cheapest hour and sell the most expensive hour, making the spread of 131,81 EUR/MWh.

Therefore, you bought the FlexHL shape for 97,88 EUR/MWh and cashed in for 131,81 EUR/MWh giving you a profit of 33,93 EUR/MWh.

For the whole year 2023 the average HL spread was 97,88 EUR/MWh. So, if you bought 10 FlexHL shapes (they trade in 100kW ticks), you would have owned 1MW*365h =365MWhs FlexHL shapes.

Bear in mind that this product is a hedge against volatility. Therefore, it will benefit you whenever volatility increases, and it decreases your returns when volatility falls. As you may remember from part I, hedging your consumption with enwex Wind and Solar shapes has the problem that is difficult to deal with residual price risks. So let us now see how the FlexHL shape can help you deal with this risk in a situation where you have bought these shapes.

Hedging a Consumption Profile with FlexHL (e.g. Battery) Shapes

We start with our 1 MW baseload consumption profile from part 1 and the volume optimal configuration of 30 Wind shapes and 26 solar shapes to hedge your 1 MW baseload consumption. Bear in mind that Enwex shapes are traded in 100 kW (0.1 MW) instalments, as to allow market access to smaller players. So in capacity, we bought the equivalent of 3 MW wind and 2.6 MW solar. Just like with the FlexHL shape, this allows you to avoid building these assets yourself.

Graph 4: Average Wind and Solar production in 2023 over a day with Wind and Solar shapes from enwex

As you may remember from part I, you can buy Wind and Solar shapes on PowerMatch but they will not fit your consumption profile perfectly. See Graph 4. They are highly useful to hedge away most of your overall price risk, however we need the FlexHL shape to perfect your hedge and allow you to insure yourself against volatility.

Now the question is how many FlexHL shapes you should buy to hedge against price volatility in such a situation. If I price the FlexHL fairly at 97,88 EUR/MWh, the amount of FlexHL shapes does nothing to my returns, as they are fairly priced. Remember from part I, where we learned that a fair priced hedge does nothing to returns. The point of a hedge is precisely that you do not know how prices will develop. In part I with the renewable shapes we needed to shock the system with a 50% price increase and a 50% price decrease in order to see how our hedge plays out in practice.

However, shifting the price level around in this way will not really help us in this case, as volatility will not change. This of course isn’t the case in the real world, where price volatility and price level are closely connected. However, we are operating in a simplified, modelized world so we need to do something else. In order to see the FlexHL shape do its magic we need to shock the system by increasing and decreasing volatility.

Shocking Volatility

Based on actual prices in 2023 we artificially increase or decrease volatility according to the following formula:

New price in a given hour = (average of price for the whole year) – shock_param * (old price in a given hour – average of price for the whole year)

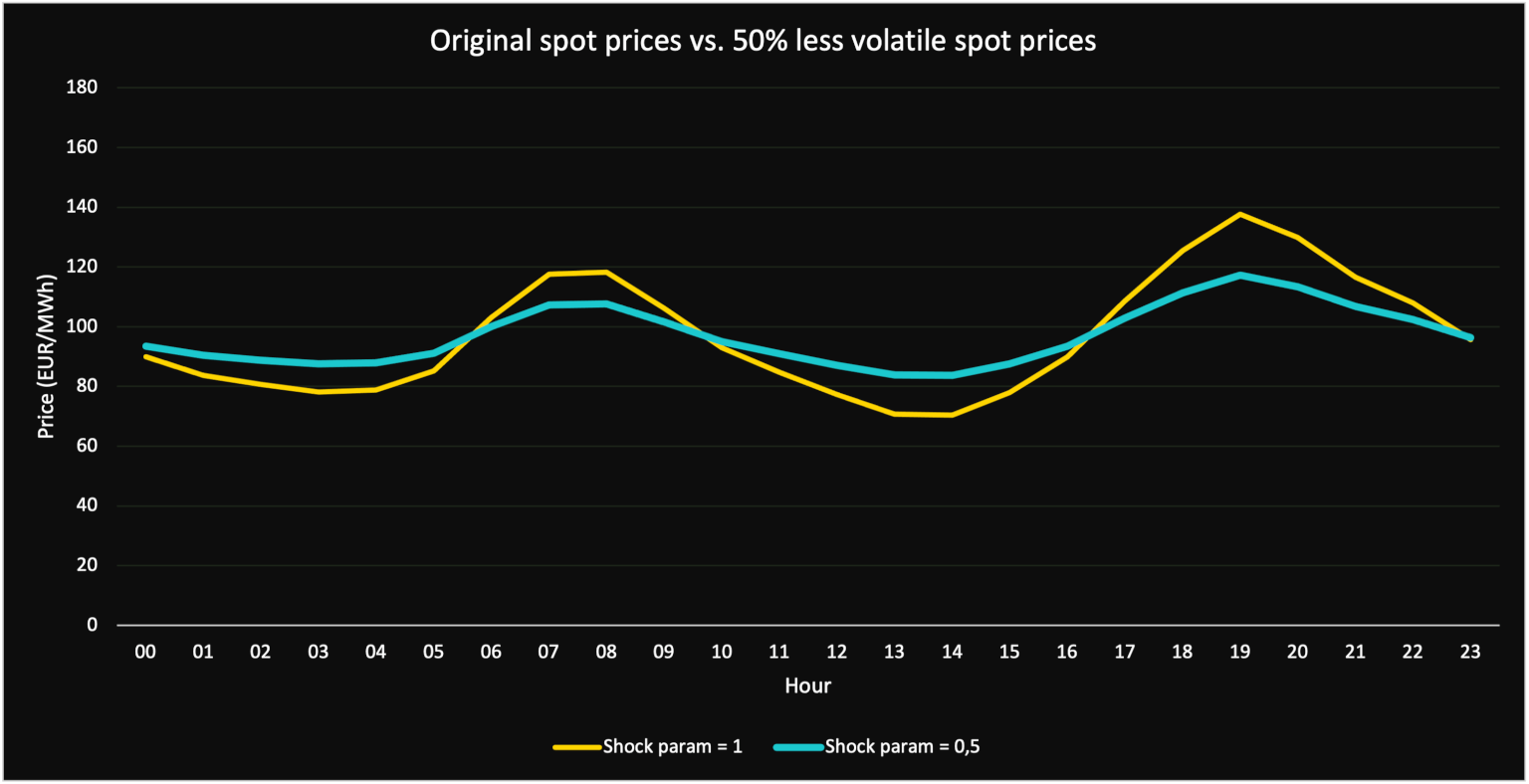

This transformation does not change the average price in 2023 but it increases prices that are above the average and decreases prices below the average thereby playing around with the volatility of prices. We kind of tear prices apart from the average. The (shock_param) dictates the volatility level. Values higher than 1 will increase volatility, and values between 0 and 1 will decrease it. So, this transformation is equivalent to increasing the variance of prices. Take this just as one example to illustrate how the FlexHL product works. In reality there are many ways to play around with volatility but we want to keep it as simple as possible.

Under a scenario where volatility increases by 50%, spot prices of an average day would look like this:

Graph 5

If we decrease volatility by 50%:

Graph 6

As the FlexHL product financially compensates for fluctuating residual positions by offering to buy at the cheapest price of the day and selling at the highest price (i.e. arbitrage), its “fair” price is given by the average high-low spread during a given period. With 2023 spot prices, the annual fair value would have been 97,88 EUR/MWh. Because of the nature of the spread logic, the value of the FlexHL product will not change with increasing/decreasing price levels. But it is sensitive to volatility, which makes high/low prices more/less extreme. With 50% higher volatility, the FlexHL product will see its price rising to 146,82 EUR/MWh. 50% lower volatility reduces arbitrage potential with the average value decreasing to 48,94 EUR/MWh. Plotting this graphically, we see that the value of the FlexHL shape increases/decreases in a linear way depending on the chosen volatility parameter which we use to shock the system.

Graph 7

The linear relationship between volatility parameters and the capture price of the HL Flex product comes from the way we set up volatile prices. A more crucial point here is that the Flex HL shape becomes more valuable as high and low prices diverge further.

When spot prices fluctuate a lot, the residual positions of the Enwex hedge with wind and solar shapes becomes costlier, as discussed above. When there is little solar or wind, spot prices tend to go up, and that is exactly when you need to buy back power on the spot exchange, which is now more expensive. Likewise, excess power you have from Enwex products is likely to be less valuable because spot prices will be low, too. As such, under high-volatile scenarios, the average costs of a consumption portfolio with an enwex hedge (assuming the same hedge sizes and prices) will rise. Graph 8 indicates this relationship.

Graph 8

Looking at Graph 7 and 8 we are now in the situation of a hedger’s dream, namely that we have two products that are negatively correlated. The value of the FlexHL shape increases with volatility, while the value of a consumption profile that is hedged with Enwex decreases with volatility. Or as in our graph 8, the portfolio costs increase with volatility. Therefore, the Flex HL shape can be used to hedge this risk.

How Many HL Flex (e.g. Battery) Shapes to Recreate Baseload?

As an offtaker, on top of hedging the price level of your consumption profile with optimal Wind and Solar shapes, you can now shield yourself from residual risks and increasingly volatile spot prices by purchasing the FlexHL product. The next question to ask is then how many FlexHL shapes you need to buy to recreate the baseload/or pay as consumed hedge financially. For simplicity, we assume that the price of the FlexHL product is its capture price in 2023 (benefit of hindsight) and that we stick to the same Enwex hedge configurations from our exercise in part I. Then we find an optimal size of the FlexHL product that allows you to level with the baseload product. Our optimizer arrives at the optimal size of 48 FlexHL shapes. This is the size that offsets additional costs from more volatile prices by additional gains of HL Flex product (compare graphs 7 & 8).

How the FlexHL & Enwex Combination Works to Recreate a Baseload Hedge

We start with our baseload consumption profile from part I of 1 MW i.e. 8760 MWhs per year for 2023. We hedge the price level of this consumption profile with the optimal configuration of 30 Enwex wind for a fair price of 76,16 EUR/MWh and 26 Enwex solar shapes at a fair price of 74,13 EUR/MWh. And we add in 48¹ FlexHL shapes at a fair price of 97,88 EUR/MWh. Graph 8 shows you the payoffs, which are the same for all configurations. As everything is fairly priced, all configurations have the same costs at 833.737 EUR and 95,18 EUR/MWhs. Again, a fairly priced hedge has no impact on returns.

¹ The precise optimal FlexHL is 48,15599948. Under this volatility setup, if the volatility parameter is less than unity, the optimal FlexHL size would be 0 (Enwex will be always cheaper than baseload). When the parameter is greater than 1, the parameter does not affect the optimal size (48,15599948).

Graph 9

Now we shock the system by increasing price volatility by 50%. You can see in Graph 10 that total Enwex costs have increased, as the residual position has become more expensive due to the increase in price volatility. Total consumption costs with the Enwex hedge has increased to 105,00 EUR/MWh. The baseload hedge case and the no hedge case scenarios have stayed the same because the former is a perfect hedge, and the no hedge scenario doesn’t change as we don’t change price levels but only volatility. Again, in practice both would change together, but we live in a model world. The important point is that the cost of the Enwex hedge + the FlexHL shape also has not changed. The FlexHL revenues are now higher than the costs, as it offsets the money lost in the higher residual costs. The FlexHL shape makes 86,019 EUR in extra revenue, offsetting the 86,019 EUR in additional spot costs. Thereby, the hedge works perfectly to recreate the baseload hedge.

Graph 10

So let me remind you why we went through these examples and exercises in part I and part II. It is our firm belief that modern energy purchasing will have to move away from the simple purchasing of baseload profiles, if you want to source green energy and more importantly if you want the best prices.

On PowerMatch you can currently buy Wind for less than 60 EUR and PV for less than 50 EUR for the next years which is substantially cheaper than buying baseload. While this very well hedges the exposure to overall price levels in the next energy crisis, it does leave you with residual spot risk. This risk you can now hedge with a FlexHL shape, which is just like building a battery on your premises only simpler. We will explain how a battery asset can use the FlexHL to hedge its returns in an article coming soon. We have developed the PowerMatch suite to allow you to purchase green energy and hedge your residual risk at prices that you will not get in the old baseload world very easily. We invite you to contact us and discuss these new opportunities as we see it as our job to provide you with trading and hedging solutions that allow you to get green power at the best prices while being able to sleep soundly through any movements on energy markets.