Market Value of Renewables

The market value is a metric that measures how valuable electricity coming from a particular plant is. It helps us understand how higher shares of renewables collectively lead to lower returns and its implications for the ongoing energy transformation.

Cost vs. Value

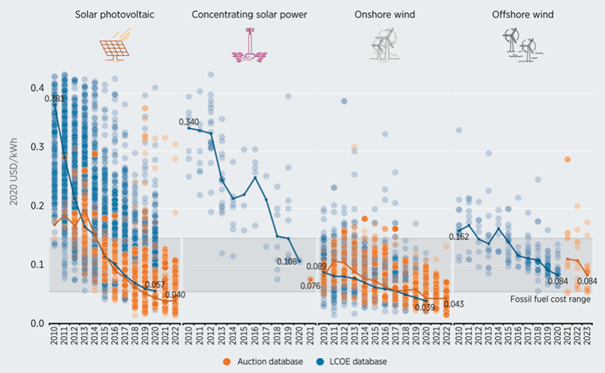

Variable renewable energy (VRE) plants have seen their investment costs decline significantly in the last decade (figure below). This is definitely good news for achieving our goals to decarbonize the energy system. However, that is not the whole story from the perspective of asset owners who invest in renewable power plants. We need to compare lifetime costs of VRE plants against revenues they are expected to make over the lifetime to assess their competitiveness and profit opportunities.

IRENA (2021) Renewable power generation costs in 2020.

How to measure value of renewables

An often-used value metric is so called market value (also called capture price). The market value is calculated as the volume-weighted average price at which a power plant sells electricity on the market during a certain timeframe (e.g. year). If the price increases, the market value increases accordingly. But how much it increases also depends on how much a power plant produces at that price. For example, even if the market price is high, the market value will not be as high if the power plant produces only little during that hour.

More renewable in-feed, less valuable electricity per output

The massive expansion of wind and solar power plants in the last decade has displayed a negative correlation between the price they receive and the volume they provide. Since their production depends on weather conditions, they operate only at certain times (e.g. daytime). When they do, they generate electricity at the same time. An increase in wind and solar output at specific time periods increases electricity supply significantly, which leads to systematically lower prices at those times. As more VRE capacity is installed and generates more electricity, their electricity becomes less valuable (see Hirth (2013) for more details). People call this tendency "self-cannibalization effect" of renewables, but essentially this is just a standard supply-demand relationship (at a specific time period): if supply increases for given demand, the market price drops.

Observe the value drop

The chart below makes this relationship between renewable production and the market price clearer. It shows a snapshot of the market price development in tandem with the residual load (total demand less wind/solar production; zero residual demand means all demand is satisfied by wind and solar) over one week in Germany. When wind and solar are producing a large amount of electricity, the residual demand drops. So does the price. When renewables meet most of the demand or produce more than demanded, the price falls to or even below zero (even during the recent energy crisis!), which reflects the low variable production costs of wind and solar. Conversely, when there is still demand left to be met, other power plants (e.g. gas) operate and drive up the price, as in several spikes during the week in the chart.

Renewable asset owners build their plants in places where sunshine is abundant or the wind blows to maximize output. This necessarily leads to simultaneous production from plants in the proximity due to similar weather conditions and collectively inflates the negative correlation between the price and the production volume.

Going back to the market value definition, we can now see that when VRE produce electricity, the price tends to be low. When they do not operate, the price tends to be high. This results in lower market value compared to other conventional power plants.

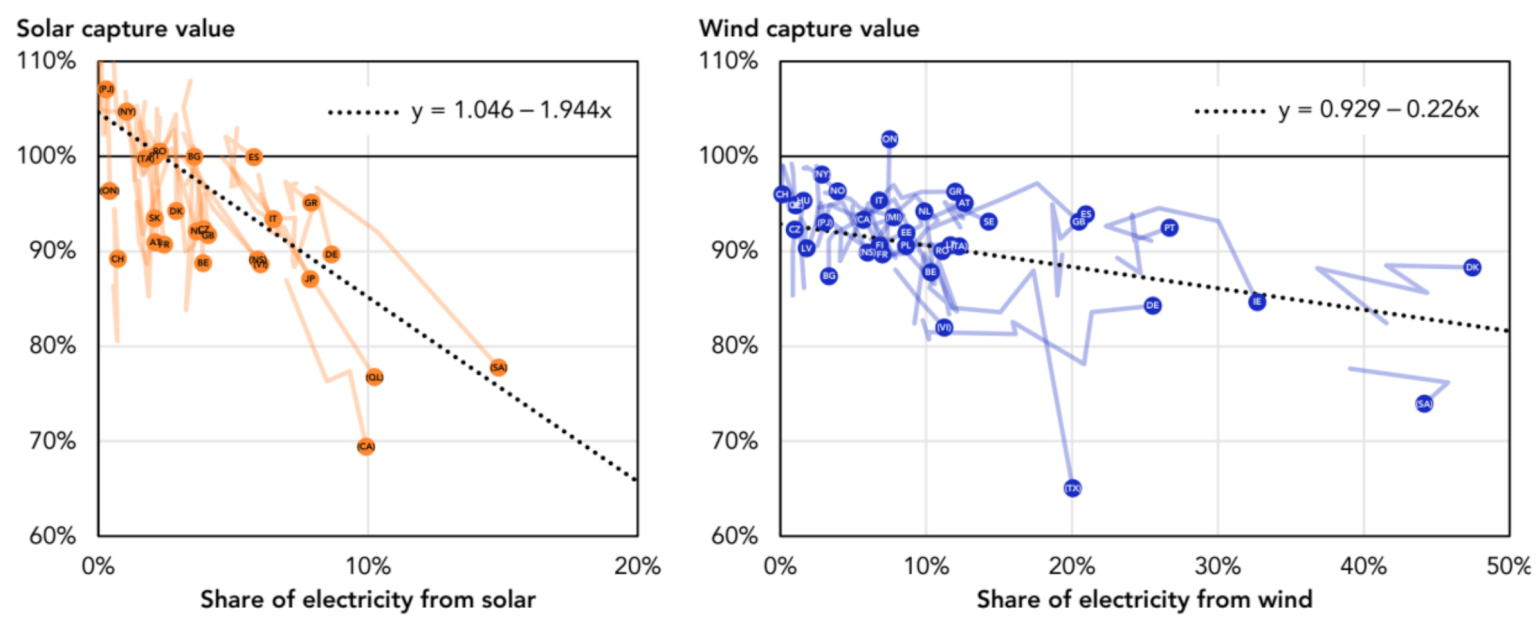

By scaling the market value of wind and solar by the baseload market price (price at which a 24/7 baseload plant would get on average), we get a clearer picture of 'cheap' renewable electricity, which is called value factor (also known as capture rate). The figure shows that the value factors of wind and solar are consistently lower than 1 (parity with the base price) across several countries, as their market shares increase. Despite some variation among individual countries, the trend is clear: the higher the shares of VRE in electricity production, the cheaper and therefore less valuable their electricity. Wind and solar receive systematically low remunerations.

Halttunen et al. (2020) Global assessment of the merit-order effect and revenue cannibalization for variable renewable energy.

Dealing with the value drop

This is nothing more than a consequence of the typical supply-demand relationship. But it has many important implications for wide-ranging topics about electricity market designs – negative prices, batteries, demand response, support schemes (subsidies), long-term contracts, and market splitting, to name a few.

For renewable owners, for example, this consistent value drop poses future price risks, which opens up a need for long-term contracts. Although many VRE plants are currently shielded from price risks to some extent through subsidies such as FiP, subsidies are not a perfectly efficient solution in the long run as they distort production behavior (e.g. negative prices) and may unnecessarily burden consumers. We believe that in the future, VRE developers will need to manage price risks on their own through, for example, PPA (power purchase agreement) contracts. To reflect renewable-specific production profiles in such contracts, understanding the underlying value of electricity and forecasting the longer-term trajectories becomes crucial (enwex for example publishes daily updates of market values and wind and solar value indices).

From Action to Zuccess

Knowledge is Key

Achieving 100% Renewable Energy is a generational task which requires innovation and knowledge on an unprecedented level. We will get faster to 100% Renewable Energy when we as a generation share as much information as possible with each other. This is what we strive for with our School of Flex.

Flex Index

"How much money can I make with a battery?", we get asked a lot. To answer this question, we created the Flex Index, which is a transparent reference for the value of flexibility on the German power market. Check it out...

Videos & Podcasts

Nothing beats first-hand knowledge from experts. Our energy traders and engineers give insights into their job, the market environment they operate in, and what we are working on.

Flexicon

Everything you need to know about flexibility in energy markets in one place?

Written by experts for experts and beginners alike? This is what we strive for with our Flexicon.

Discover our Services

FLEXPOWER helps you to bring your portfolio to the energy market. We combine over 25 years of experience in renewables trading in our seasoned team of short-term energy traders. We manage large-scale renewable portfolios and flexible assets with our lean and fully digitized approach.