Uniform Pricing, Pay-as-Clear, Marginal Pricing – all the same thing?

In many cases, the terms marginal pricing, uniform pricing, and pay-as-clear are used interchangeably. In the electricity market, all three are used to explain pricing and the merit order. However, each term describes a slightly different aspect of the market process that leads to the same result.

Definition

Uniform-Pricing

Uniform Pricing refers to a situation where all buyers in a market pay the same price for identical products or services. This contrasts with price discrimination, where different prices are charged for similar transactions, depending on the buyer or seller.

Marginal Pricing

Marginal Pricing is an economic model that explains a specific type of pricing. It posits that in competitive markets, the equilibrium price (where supply and demand are equal) is largely determined by the producers with the highest marginal costs (at the equilibrium point).

Pay-as-Clear

Pay-as-Clear is a specific auction method primarily used for commodities. In this auction mode, each additional bid becomes less favourable for buyers. Once demand is met, all buyers pay the price of the last, least favourable bid.

Why Are the Terms Often Used Interchangeably?

In fact, Pay-as-Clear and Uniform Pricing Auctions—also known as Marginal Pricing Auctions—refer to the same auction mode. Such sales auctions always start with the lowest bid, including both price and quantity. Bids are then increased until a predetermined total quantity has been auctioned off. The unique feature is that every bidder is immediately awarded a bid, but ultimately, the last (highest) price applies to all buyers and sellers, regardless of the bids previously placed. In purchase or procurement auctions, the process is reversed, and the lowest price awarded applies.

This is exactly how electricity is auctioned on the spot markets in Germany and many other countries. In relation to auctions, the three terms are used synonymously, although they shed light on different aspects. This becomes clear when you consider what two of them actually mean.

What is Marginal Pricing?

Marginal pricing focuses on the producer side. It addresses the economic considerations that lead to different suppliers with varying cost structures charging the same price for a particular good.

This is especially relevant for homogeneous goods such as electricity, as well as natural resources like crude oil, aluminium, or gold. Daily world market prices are also set for agricultural commodities such as soybeans, cotton, coffee, and even live cattle. Some of these goods are sold in pay-as-clear auctions, but not all.

While significant differences in quality - in the case of food, for example - are sometimes honoured with considerable premiums or discounts, these do not exist for electricity. Therefore, there is no reason for the operator of a solar or wind power plant to sell electricity cheaper than the operator of a gas-fired power plant must charge to cover costs. In a free market, buyers would anyways outbid each other to purchase the cheaper wind power until its price matches that of gas powered plant. This price is known as the market-clearing price or equilibrium price, where supply and demand are balanced.

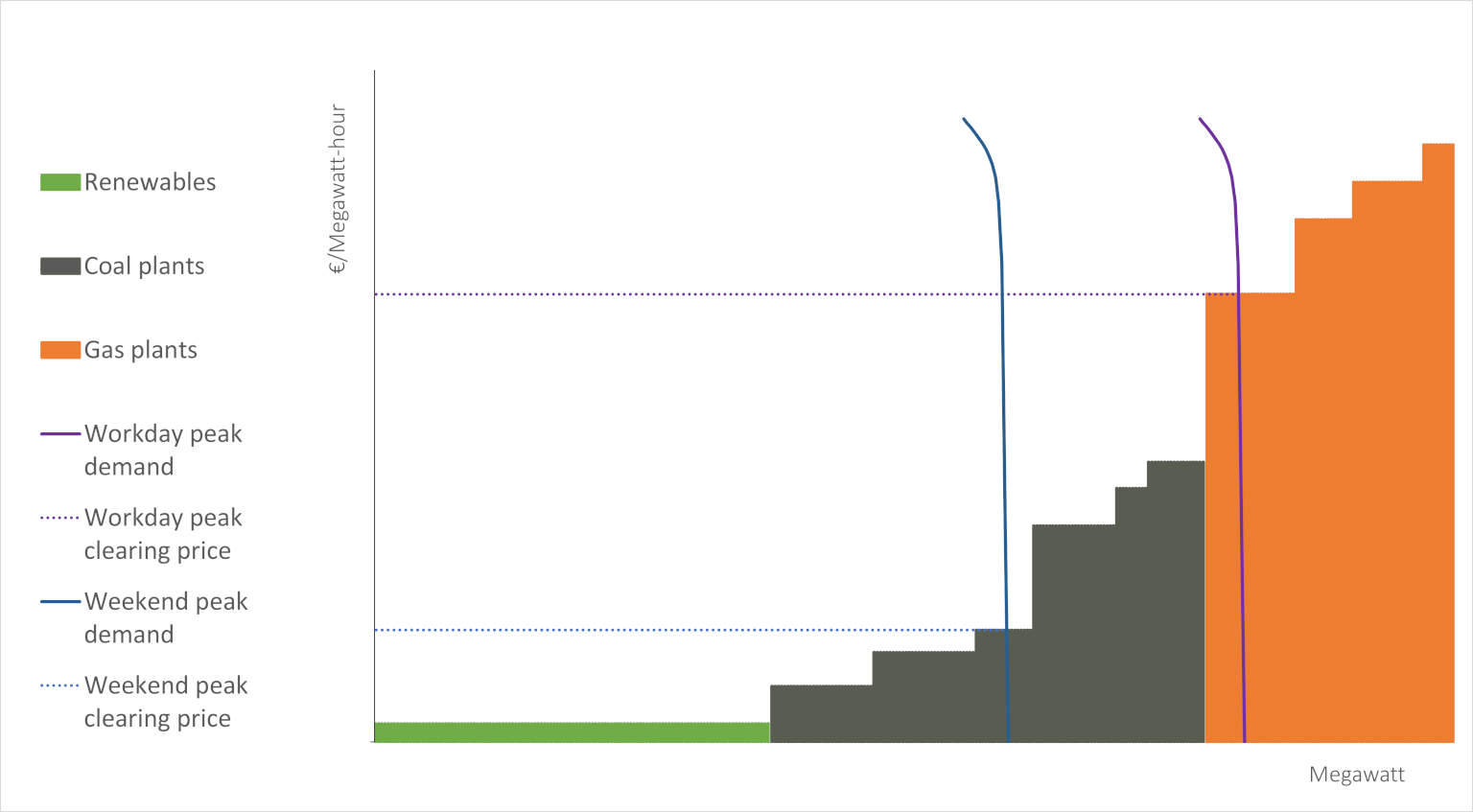

The low marginal costs of renewable energies mean that their electricity supply is utilised first, followed by various types of coal and gas-fired power plants. Given marginal costs, the unit price is based on demand: the price is equal to the marginal costs of the most expensive power plant required.

In such a market, the price only decreases when the most expensive supplier (such as the gas-fired power plant) is no longer needed to meet demand. This can occur if demand falls or if suppliers with lower marginal costs can produce more, resulting in a new equilibrium price. This explains why electricity prices in Germany drop when there is an abundance of wind and solar power and no gas-fired power plants are required.

The term "marginal pricing" originates from the fact that suppliers set their price at their marginal costs. They thus choose the lowest price that allows them to produce without incurring losses.

What is Uniform Pricing?

The term 'Uniform Pricing' refers to the practice of charging the same price for a product to all buyers within a particular market. This approach is common in many retail chains, where all customers pay the same amount for the same product, regardless of factors such as age, purchase quantity, or financial status. This is in contrast to price discrimination.

Price discrimination involves charging different prices to different customer groups based on various criteria. For example, children, students, and pensioners often receive discounted entry to zoos. In the high season, holidaymakers are more willing to pay, while in the low season, holiday hotels with cheap offers also attract guests who might otherwise have stayed at home. Additionally, guests who stay for less than a week might face a surcharge. These practices are examples of price discrimination.

The goal of price discrimination is to better exploit the varying willingness to pay among different customer groups. However, this strategy is less feasible for commodities due to their homogeneity, intense competition, and market transparency. Suppliers of commodities generally lack pricing power, and any price differences are quickly eliminated by arbitrage transactions, resulting in minimal change to the market price. Moreover, the price elasticity of many consumers is typically high for commodities: hardly anyone travels by train more often because the price of petrol rises. And only a few companies reduce their electricity consumption because the price goes through the roof.

What does Pay-as-Clear stand for?

The term "Pay-as-Clear" refers to an auction mode where a market-clearing price is determined.

As seen, the marginal pricing model describes why the price of a homogeneous good - following the market mechanisms - settles at the level of the highest marginal costs of all suppliers required to reach the equilibrium price, which is then a uniform price.

Pay-as-Clear auctions are, to a certain extent. the commodity markets' admission that the market mechanisms - or rather, that the behaviour of the players - leads to the described uniform price anyway. They serve as an institutionalized shortcut to the pricing outcome that would occur anyway when goods are traded freely.

Although 70 to 80 percent of electricity in Germany is traded bilaterally, directly between producers and consumers "over the counter" and outside of the exchange, the exchange price remains crucial for these transactions. This is because the exchange price reflects all the relevant information that market participants need for negotiations. Consequently, if a transaction deviates significantly from the exchange price, the disadvantaged party would likely reject it and sell the electricity on the exchange instead.

On which electricity markets do Uniform Pricing and Pay-as-Clear apply?

The described market mechanisms of Marginal and Uniform Pricing apply in principle to all liberalised electricity markets worldwide. Uniform Pricing, in the sense of an electricity grid-wide uniform price, is implemented in parts of the USA and Australia, and India is also considering establishing a national electricity market with uniform pricing.

In Europe, Uniform Pricing is the predominant principle for electricity pricing. This applies even to countries with electricity market designs that differ significantly from Germany's, such as the United Kingdom, where remuneration is provided not only for electricity produced but also for the availability of reserve capacity.

In EU countries like Sweden and Italy, the market is divided into multiple price and auction zones, meaning that there is no single standardized national price. However, according to the German Parliamentary Research Service, the price within the bidding zones is still determined by Pay-as-Clear. For day-ahead trading, the European Union even stipulates this in Regulation (EU) 2019/943 on the internal electricity market and Regulation (EU) 2015/1222 on capacity allocation and congestion management.

Regional Pricing in the electricity market

Nodal and Zonal electricity pricing systems are often cited as an alternative to Uniform Pricing. In reality, these are also Uniform Pricing systems, but they are applied to much smaller areas. This allows for different prices to be set across a national territory. In Zonal Pricing systems, electricity grids are divided into various zones, each with its own price, as seen in countries like Italy and Sweden. In Nodal Pricing systems, prices can vary even at individual grid nodes, such as substations where electricity transitions from transmission grids to medium-voltage and distribution grids.

These pricing methods have the advantage that the price signal not only includes physical generation shortages, but also transmission shortages, thereby promoting efficient utilisation of the electricity grid. However, the greater the fragmentation in pricing, the less transparent the market becomes. Moreover, with fewer players involved in price formation, competition can be diminished. In extreme cases, this can enable individual players to exert monopoly-like power at specific grid nodes, potentially undermining the principles of marginal pricing.

From Action to Zuccess

Knowledge is Key

Achieving 100% Renewable Energy is a generational task which requires innovation and knowledge on an unprecedented level. We will get faster to 100% Renewable Energy when we as a generation share as much information as possible with each other. This is what we strive for with our School of Flex.

Flex Index

"How much money can I make with a battery?", we get asked a lot. To answer this question, we created the Flex Index, which is a transparent reference for the value of flexibility on the German power market. Check it out...

Videos & Podcasts

Nothing beats first-hand knowledge from experts. Our energy traders and engineers give insights into their job, the market environment they operate in, and what we are working on.

Speaker wanted?

You are on the hunt for a speaker on topics such as power trading, battery energy storage, or the need to balance renewables?

Ask for a speaker and we will send one of our experts to your lecture or conference.

Do you have it in you to be an energy trader?

Find out by taking the ultimate power trader's quiz and answer questions on energy markets and trading strategies!

Discover our Services

FLEXPOWER helps you to bring your portfolio to the energy market. We combine over 25 years of experience in renewables trading in our seasoned team of short-term energy traders. We manage large-scale renewable portfolios and flexible assets with our lean and fully digitized approach.