What do companies need to know about energy procurement?

High and volatile energy costs are a problem for many companies. This makes strategic energy management, including optimized power procurement, all the more important. Long-term supply contracts help consumers to protect themselves against price fluctuations and to take advantage of low prices to reduce costs.

Definition: What is energy procurement?

Energy procurement is the process by which companies obtain the energy they need for their business and production operations.

For most organizations, this is primarily electricity and, if not electricity, another energy source for space or process heat, such as gas and oil or district and geothermal heat. In a broader sense, the purchase of fuel for company vehicles can also be counted as energy procurement.

However, as we move towards an all-electric society, power procurement is often equated with the purchase of energy, regardless of the purpose for which it is used. For the purposes of this article, the terms are largely used interchangeably.

We optimize your power procurement

Our expertise in optimizing and trading consumption profiles, combined with the longest trading experience on German short-term markets and our PPA platform PowerMatch, offers you dynamic power procurement.

Why is energy procurement becoming more important for companies?

The energy transition - towards a sustainable energy system - requires major investments and decisive action. For companies, this affects power procurement in a variety of ways.

Sustainability

Many companies have long realised that acting sustainably not only enhances their image, but can also bring direct economic benefits. In addition, many managers and employees are personally committed to making a contribution to the energy transition and thus to a sustainable economy.

Legal regulations

The Energy Efficiency Act (EnEfG) requires companies with an annual power consumption of more than 7.5 gigawatt hours (GWh) to set up an energy or environmental management system (EMS) by May 2025 in order to analyse power consumption in detail and identify potential savings. In addition, companies that consume more than 2.5 GWh per year must publish plans for economically viable energy-saving measures by September 2026.

According to a survey commissioned by the German Federal Centre for Energy Efficiency (BfEE), these regulations affect around 23,000 companies of all sizes in Germany alone. However, it is also worthwhile for smaller companies or players in sectors with low energy requirements to reconsider their power procurement. The EU Energy Efficiency Directive also requires around 50,000 companies across Germany that are not classified as small and medium-sized enterprises (SMEs) to carry out regular energy audits.

Electrifying the economy

Despite increasing efficiency, demand for electricity is likely to rise in the coming years. Forecasts commissioned by the Federal Ministry of Economics and Technology in 2022 predict an increase to 658 terawatt hours (TWh) in 2030. Compared with 512 TWh in 2024, this would represent an annual increase of just over four per cent. A more recent analysis by McKinsey & Company suggests a lower increase of between one and two per cent, and a maximum of four per cent, to 530 and 615 TWh.

According to this analysis, the increase in demand will come mainly from the electrification of transport and the heating market, as well as from the growing demand for data centres.

How the power demand will develop in a specific company is, of course, completely open. That would be the task of strategic energy procurement planning.

High power prices

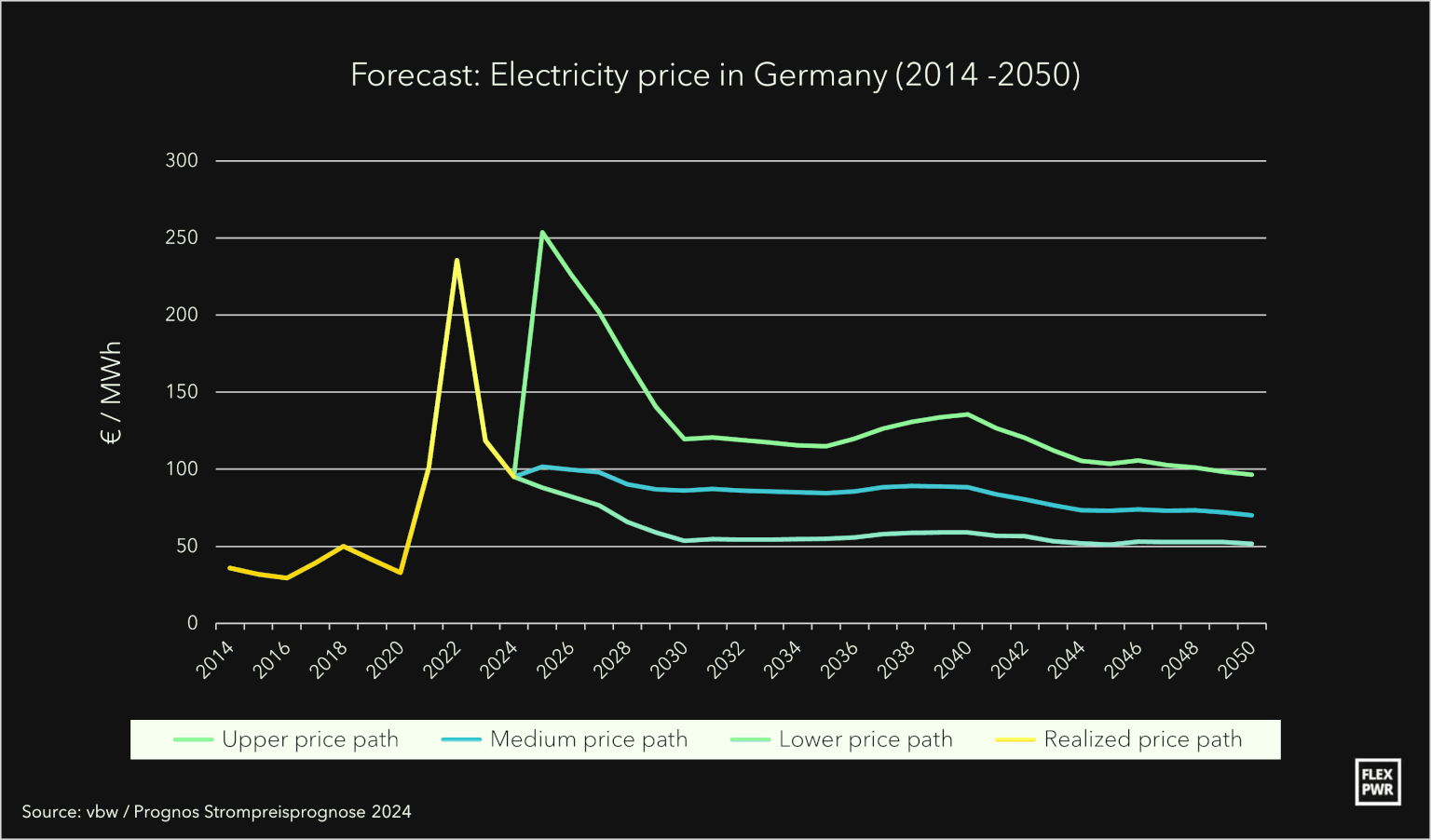

According to calculations by the British think tank Ember, average prices have mostly been between €70 and €100 per megawatt hour (MWh) since the beginning of 2023. This is significantly cheaper than in mid-2022, when one price record followed another on the energy exchanges. At the same time, electricity is still around 2.5 times as expensive as it was in the middle of the last decade.

The main reason for this is not renewable energies, as is often claimed, but the rapid rise in the price of natural gas. Gas-fired power plants only supply power when the much cheaper renewable energies do not deliver enough power. During this time, however, their high marginal costs determine the market.

In the record month of August 2022, a megawatt hour (MWh) in Germany cost an average of €463.59. Source: Ember

In view of these energy costs, many companies are increasingly focusing on their power procurement. Especially as average power prices are unlikely to fall in the near future. This is also the conclusion of a study conducted by Prognos, an analysis and consulting company, on behalf of the Bavarian Association of Industry and scientists from the Friedrich-Alexander University of Erlangen-Nuremberg (FAU).

Prognos predicts a likely decline in power prices of around 10 per cent to €86/MWh between 2024 and 2030. By 2050, the price of power could fall to €70/MWh.

Volatile feed-in, volatile power prices

The energy transition and the associated restructuring of the power supply bring a high degree of volatility to the power market. This is neither a bug nor a feature, and has little to do with fluctuating demand.

The reason is, quite literally, the nature of the dominant energy sources: Wind and solar are very cheap, but they can only be controlled to a limited extent. When they supply power, prices fall. When they do not supply power, demand must be met by more expensive generation alternatives, whose marginal costs then determine the price of power in accordance with the laws of the market.

In one way or another, companies have to face this reality when sourcing power. And they have a range of options.

In which areas can companies optimise their energy procurement?

High and volatile prices - an unpleasant combination for purchasers. The good news is that the restructuring of the power supply offers consumers increasing room for manoeuvre - at various levels.

The higher the share of energy in a company's value added or total costs, the more urgent the need for long-term, well thought-out energy management. However, even companies with relatively low power requirements can now identify and use potential savings with comparatively simple means.

Prosuming

The decentralization of power generation makes it easy for prosumers to cover at least part of their power consumption themselves - typically with a rooftop PV system. If you have enough space on your business grounds, you can also optimize your power supply with a battery storage system.

The more power you use yourself, the more attractive these options become. In the long term, it may therefore be worthwhile to increase the role of power in the energy supply - for example by using heat pumps and electric vehicles in the company.

Market-based scope for action

As in the stock market, high volatility not only creates risks but also opportunities. Miscalculations can lead to unnecessarily high costs. On the other hand, those who manage to buy power at the right time can save considerable sums.

Flexibilization

Companies can also influence the price of externally generated power by making their power consumption more flexible through various measures. The challenge for industrial companies is to identify processes and power requirements that can be postponed in order to respond systematically and flexibly to fluctuating power prices.

Providing system services

Large consumers also have the option of providing ancillary services. These are measures that serve to stabilize the power grid. The grid operators pay a compensation for this.

How can companies save money on power procurement?

Holistic energy management requires a high level of planning and foresight - not only for power procurement itself, but for the entire company. This includes, for example, improving energy efficiency within the company.

The specific measures that can be taken depend very much on the sector, the business model and the condition of the properties and facilities. For example, it is often possible to generate significant amounts of space heating through the targeted use of waste heat from server rooms and manufacturing processes. The precise sizing of IT systems and lighting, as well as the high occupancy rate of workplaces, often holds underestimated savings potential. Intelligent control of systems can pay for the investment more quickly than originally anticipated.

Power procurement costs can also be reduced. In some organizations, it may be worth hiring specialists or creating a dedicated department. However, even internal experts will seek support from external service providers in various areas.

Prosuming

Own generation and energy storage systems can be part of strategic power procurement. Many small businesses now offer professional installation and maintenance of these systems. There are specialist service providers for trading these systems - power traders whose expertise is also used by companies whose business model is based on operating systems.

Generation systems

For smaller PV systems, the fixed feed-in tariffs under the Renewable Energy Sources Act (EEG) may be sufficient to recoup the investment within a reasonable time, especially in combination with own consumption. However, the larger the system, the lower the feed-in tariff (see table) and the more worthwhile professional direct marketing becomes. According to the EEG, power from systems of 100 kilowatts (kW) or more must even be sold on the market via a direct marketer.

But even for smaller systems, direct marketing can often generate higher returns, reducing the time it takes for solar or wind systems to pay for themselves and become an additional source of income.

Battery storage

The same goes for battery storage. The investment can be worthwhile if you store power from your own rooftop PV system to power servers and security systems overnight. However, marketing flexible storage systems can bring much more. For example, unused factory space can be put to productive use to generate additional revenue, while at the same time adding a security component to your own power procurement.

Market-based scope for action

Optimizing power procurement on the market can be a first step towards energy efficiency in the company. However, volatile prices present many energy purchasers with a dilemma: do they buy an all-inclusive package for a lot of money or do they try to wait for favorable moments with the risk of missing them and paying more? The decision is likely to depend not only on the nerves of those responsible, but also on the business model and its demands on the power supply.

Full supply at a fixed price

A fixed price for power 24 hours a day, 365 days a year is still possible. However, most power suppliers now only offer this with substantial surcharges because they then bear the full risk of volatility on the power markets.

Procuring power yourself

Other companies use their own buyers to procure energy. In addition to the futures market, power purchase agreements (PPAs) - i.e. long-term contracts to buy power from operators of renewable generation plants or virtual storage facilities - are an option here. Such contracts can be concluded directly with the suppliers or via platforms.

The benefits: PPAs ensure that the purchased power comes from renewable energy sources while securing a fixed, usually favorable, power price for the quantity purchased. The market values for wind and PV are significantly lower than the general baseload price for power. The downside is that if the quantities purchased do not exactly match actual demand, the difference must be traded on the spot market at short notice.

The downside is that high supply volumes from PPAs are usually associated with low power prices and vice versa. Any shortfall in supply therefore has to be made up at great expense, while surpluses rarely generate high spot market prices. However, PPA customers can protect themselves against this price and volume volatility by using a virtual battery. This involves shifting loads between times of day to achieve more favorable buying and selling prices for the users of the virtual battery.

Contracting power traders

DHowever, the increasing share of renewables is making this task more challenging. This is why electricity trading companies have entire teams dedicated to forecasting generation based on weather forecasts and, in turn, calculating future power prices by comparing them with demand trends.

To get the best trades, they operate in all markets: the futures market, the day-ahead market, and even rolling intraday trading with prices that fluctuate by the second. Even municipal utilities, whose business is (retail) power trading, are therefore happy to place their power procurement in the hands of external power traders.

Flexibilization

Power consumers who can make their power procurement more flexible have greater potential for savings. In other words, they can adapt their consumption - at least in part - to the availability of renewable, and therefore cheaper, power.

This kind of flexibility not only makes it easier to use renewable energy, it also has great monetary value. The high volatility of the spot market makes it possible to buy power at extremely low, sometimes even negative prices. Therefore, even a few percentage points of load shifting can be a real competitive advantage. The prerequisite for this is so-called spot exposure, i.e. at least partial dynamic power procurement on the short-term markets. Modern power trading companies now also offer access to the highly volatile intraday markets, which allow demand to be adjusted to sometimes extreme prices.

Partly dynamic/partly hedged power tariffs

With partly hedged tariffs, customers cover a large part of their demand at a fixed price. This can be done through an power supplier who provides a certain amount of power at a fixed price. If the power is sourced from sustainable energy sources, PPAs are an option for the base load.

The remainder of the power demand is covered by the spot market. This offers good opportunities for very cheap power, but also carries the risk of having to buy at very high prices on some days. To avoid this, modern utilities can build flexibility options into the supply in the form of virtual battery.

By making their consumption more flexible, companies can take advantage of the sometimes very low spot market prices when procuring power. Virtual batteries can be used to protect against price spikes, similar to price hedging.

On the other hand, on some days the PPA producer may supply more power than the customer needs. This surplus can either be sold on the spot market or stored in virtual batteries and used when needed.

Manufacturing companies that can schedule particularly energy-intensive processes for the increasingly favourable midday hours have an advantage here: they can buy cheap solar power on the spot market at that time of the day. However, they hedge their base load with a combination of PPAs and a fixed residual power tariff.

Food manufacturers, for example, could buy 35% of their electricity at a fixed price and the rest on the spot market. This would be worthwhile if they scheduled processes that require a lot of heating or cooling energy at times when power prices are low. To some extent, heating and cooling energy can also be generated 'for storage'. But even those who consistently charge their electric vehicle fleet at night rather than during the day can make significant savings with a flexible power tariff.

Fully dynamic power tariffs

Power consumers with fully dynamic power tariffs can benefit the most from volatility. Power is then purchased on the spot market as needed, usually on an hourly basis through day-ahead trading. However, this entails the risk of paying extremely high prices, for example during dark, windless periods ("Dunkelflaute").

This type of tariff is of interest to companies that are able to drastically reduce their power consumption during periods when there is no wind or solar power. This may be the case, for example, with older, less efficient production plants, where it is more economical to shut them down for a few hours than to operate them when power prices are high. In the medium term, this can be cheaper than paying a partially or fully hedged tariff all year round.

A fully dynamic tariff is particularly attractive for companies that already have the highest load when spot market prices are generally low. Charging infrastructure at highway service stations, for example, is mainly used in the midday and afternoon hours - when solar power generation sometimes pushes spot prices into negative territory.

Providing system services

Dispatchable loads

Companies can market their production facilities as dispatchable loads. This gives the grid operator the right to shut down their plant if the frequency in the grid drops to prevent an imminent blackout.

This option is usually available to companies in the processing industry. To participate in a tender, the production facilities must be directly connected to the medium, high or extra-high voltage grid. In addition, the dispatchable load must be at least five megawatts, although this power can also come from a combination of plants.

Balancing energy

Balancing energy is a grid reserve that is needed by transmission system operators to compensate for major frequency fluctuations. It can be provided by power plants or by large battery storage systems. Balancing energy is another way for companies to market battery storage or to offer their own flexibility as ‘negative secondary reserve’. This allows the grid operator to reduce the power purchased at short notice to prevent an imminent grid overload.

Conclusion: significant savings in energy procurement possible without investment

There is considerable potential for savings without significant investment costs through (partially) hedged tariffs or the use of virtual batteries for pure power procurement. Holistic energy management is particularly effective, combining efficient systems with the operation of your own solar or wind power systems, including power storage and flexible consumption. The most important role here, however, is played by a consumption profile that allows a comprehensive supply of power from renewable sources in real time.

From Action to Zuccess

Knowledge is Key

Achieving 100% Renewable Energy is a generational task which requires innovation and knowledge on an unprecedented level. We will get faster to 100% Renewable Energy when we as a generation share as much information as possible with each other. This is what we strive for with our School of Flex.

Flex Index

"How much money can I make with a battery?", we get asked a lot. To answer this question, we created the Flex Index, which is a transparent reference for the value of flexibility on the German power market. Check it out...

Videos & Podcasts

Nothing beats first-hand knowledge from experts. Our energy traders and engineers give insights into their job, the market environment they operate in, and what we are working on.

Speaker wanted?

You are on the hunt for a speaker on topics such as power trading, battery energy storage, or the need to balance renewables?

Ask for a speaker and we will send one of our experts to your lecture or conference.

Do you have it in you to be an energy trader?

Find out by taking the ultimate power trader's quiz and answer questions on energy markets and trading strategies!

Discover our Services

FLEXPOWER helps you to bring your portfolio to the energy market. We combine over 25 years of experience in renewables trading in our seasoned team of short-term energy traders. We manage large-scale renewable portfolios and flexible assets with our lean and fully digitized approach.