This blog post is the third in a series of articles about hedging price volatility using standard shapes such as wind and PV, as well as more novel and somewhat non-standard ones, such as the FlexHL (Battery). While the first two articles were explainers for consumers, this one is for suppliers who are looking to sell their flexibility, i.e. BESS owners. We highly recommend that you read part I and PART II before you start, as we use therein established concepts as the premise for this article.

Introduction

We last left this discussion on the importance of recognizing a shift in modern energy purchasing as consumers are transitioning from baseload profiles to renewable (wind and PV) shapes and using FlexHL shapes to further hedge the residual spot price risk. This, we explained, is a good strategy for tackling price volatility without having to build your own flexibility asset. So far, so good.

But what about actors on the supply side of things? Are they not affected by these changing energy profiles in the market? Let’s pick it up from there. In this article, we focus specifically on flexibility assets such as batteries which too need to hedge their returns because of financial risks associated with limited availability of secure contracts and multiple revenue streams (also called “revenue stacking”). Let’s break this down.

We already know that the rapid integration of renewables in the German electricity market has uniquely positioned batteries as a viable solution to the intermittency problem and paved the way for investments in BESS projects. Additionally, these batteries are highly flexible in that they can trade freely across several markets (Day Ahead Auction, Intraday Auction, Continuous Intraday and Ancillary Services such as FCR, afRR, and mFRR), which makes them even more attractive from an investment perspective. But this comes with its own set of complexities. We’ll come to that in a second.

Currently, project financing for batteries works very similarly to wind and PV - in the form of long-term contracts (e.g. PPAs) detailing the installed capacity, energy to be delivered, ancillary services requirements etc. beforehand. The big difference is that while renewables grew up in a government-cushioned subsidized environment, batteries were thrown to the ups and downs of the market from the start. Infrastructure investors that know the renewable energy space are used to low-risk, plannable investments and are therefore currently reluctant to step into the riskier world of BESS investments.

As BESS projects are usually “fully merchant” i.e. their price risk is not hedged, you can find more risk-taking investors who are looking for higher returns and willing to take higher risks in the market for BESS. Therefore, in order to entice the huge financial power of more traditional banks and infrastructure investors into the market for BESS, we need to develop a contract model that allows them to secure at least a part of their assets’ revenues in order to pay back their loans.

And this is where it gets a little tricky! If you’re a BESS owner, you’re already familiar with the fact that modelling the asset’s earning potential of selling flexibility to the market is a complex science. While access to multiple markets indeed means multiple revenue opportunities, often the path to guaranteeing these revenues is not so straightforward. We will spare you the details of revenue modelling (you can read all about it in another article we wrote on battery revenue modelling), but broadly speaking, this complexity arises from the dependency of revenues on constantly varying prices in the volatile power market that are extremely difficult to model and forecast. This forms a key risk for banks in the market for financing BESS projects that are dependent on selling flexibility on these volatile and hardly predictable markets.

Mitigating Financing Risks for BESS Assets

So, this begs the question, how can BESS owners mitigate this risk? You probably guessed it right, by hedging!

And what kind of hedge can they use? This is exactly the question we’re trying to answer here. The kind of hedge that a BESS owner can (and should) use depends on the contract they create between them and their trader/optimizer, which in turn depends on the level of risk they (and their trader) are willing to take.

As a BESS owner, it may feel intuitive to want to do away with all your risk by finding someone (your trader) who agrees to carry it. That is the maximum hedge possible and is definitely a potential option. However, what’s important to understand here is that it’s impossible to get anything for free on the market. You can’t be risk-free without giving something up in return.

In this case, a so-called tolling agreement, you simply give up on the upside (and on the downside) which then goes to your trader because they put more (here, everything!) on the line. This will become much clearer once we list the different contract types and use an example to explain all possible scenarios. But simply put: if you play safe, and your trader carries all the risk, they also get their pick of the upside.

If, however, the BESS owner has a high-risk appetite and only deals with his trader in a revenue share contract, meaning that revenues could also be very low, then they will get all the upside of their assets as well.

And then there is the third option that lies in the middle, where you and your trader both share the risk; however, the trader guarantees a certain amount of income for financing while both parties share in the upside of selling flexibility to the market at high prices.

All in all, this risk-return ratio for both actors is exactly what forms the basis for different financial contracts. An ancillary but important point to note is that any of these contracts function well only if both parties are financially strong enough to secure their commitments, which we assume to be true throughout this blog post.

What kind of contracts exist between a BESS owner and an optimizer?

This brings us to the crux of our article. There is limited relevant and verified information about the kind of financial contracts BESS assets can enter that allow them flexibility, security, or both. Even when some information is available, it is not structured well, and there exists a lot of confusion around sector-specific jargon as well as about the levels of risk and return associated with each contract. This makes the decision-making process tedious and inefficient for battery owners.

But fret not! We are here to help. We explain the different contracts that exist between a BESS and a trader. We introduce tolling agreements, revenue share agreements, and floor prices, and if you’ve understood the risk-return logic that we just explained, it should be very straightforward for you to follow along!

The purpose of this exercise is to facilitate your decision to choose the most appropriate contract for yourself. Remember, the contract that you choose determines three decisions indirectly - the trader (and their trading strategies), your affinity for risk, and the different markets in which your battery will be optimized.

Let’s dive in as we go from the least to the riskiest contract option for BESS assets:

Tolling Agreements

Tolling agreements are typically short- to medium-term contracts (1-3 years) between a BESS owner and an offtaker. The toller (BESS owner) owns and operates the battery asset and leases it to a trader for a pre-agreed “rent”. This transfers all rights to operate the battery (or limit its usage) to the trader depending on their unique trading strategies and market preferences. Naturally, all the price risk is also passed on to the trader who then bears all the downside and upside stemming from the battery’s optimization. Note that the toller continues to be responsible for all the technical management, maintenance, and administrative costs associated with the proper functioning and operational efficiency of the battery.

Unsurprisingly, this is the safest model for BESS asset owners without market risk. The battery owner gets a fixed tolling fee regardless of market prices as long as the asset is functioning and available to the trader. This stable revenue stream can potentially act as a guarantee for existing assets as well as new flexibility investments, although the discrepancy between the length of these contracts and the lifetime of an asset can create some challenges in securing financing.

Revenue Share Agreements

Another common agreement between a trader and a battery asset is a pure revenue share agreement in which, as the name suggests, the revenue generated from selling the BESS flexibility is shared between the asset owner and the trader. The split of the revenue can vary for different parties and is contractually fixed before the beginning of the agreement period. Here too, the trader has complete control over the operations of the battery as well as over the choice of markets.

This contract exposes the client to high risk, especially compared to the tolling agreement as the market risk is passed on to both parties. On the other hand, if times are good, the BESS owner also gets to take home the biggest piece of the pie in this agreement. For the trader, this contract offers a more secure revenue stream (albeit reduced upside) as the offtaking of both revenues and losses is proportionately distributed. With stakes in the game for both parties, profits and losses are dealt with together.

Revenue Share + FlexHL Floor Price Agreements

The avid reader may have already been pre-empting the third kind of contract – yes, a revenue share plus floor price agreement! This agreement works the same way as a revenue share agreement with the crucial addition of a floor price that ensures a minimum guaranteed revenue that a battery owner would make from their asset, regardless of the asset’s performance on the market.

This begs the question of what sets the floor price. At Flex Power, our approach is to use the FlexHL shape that proxies market volatility for the floor price. This shape (using historical data) captures the price spread between the cheapest and most expensive hours on the day-ahead auction and is fixed before the start of the contract. Just like a PPA for Solar or Wind can fix the feed-in price of these assets, the FlexHL can fix the price for flexibility. If you’re curious to know how exactly this FlexHL shape works as a floor price, you can read about it in our upcoming article.

This contract has a lower risk than the classic revenue share, but it is not completely absent as is the case with the tolling agreement. It embodies the middle ground between risk-return which we were discussing earlier, wherein there is some downside protection for the BESS asset and consequently, mildly reduced upside. Realistically, a BESS asset can be guaranteed at least 60% of its expected returns, regardless of how the market plays out. This guaranteed return based on a simple index should allow the BESS owner to increase leverage and thereby return on equity. The trader only participates in any revenues exceeding the guaranteed floor.

The FlexHL is our preferred contract type at Flex Power. We believe that it makes for a very attractive model for asset owners looking to secure bank financing, as the floor price insures the battery owner against extreme market volatility. At the same time, it allows for participation in the potential upside, something that’s entirely missing in tolling agreements.

How do these contracts work?

Now that we have an understanding of why there are different contracts, and what those different contracts are, it’s time to see them in action.

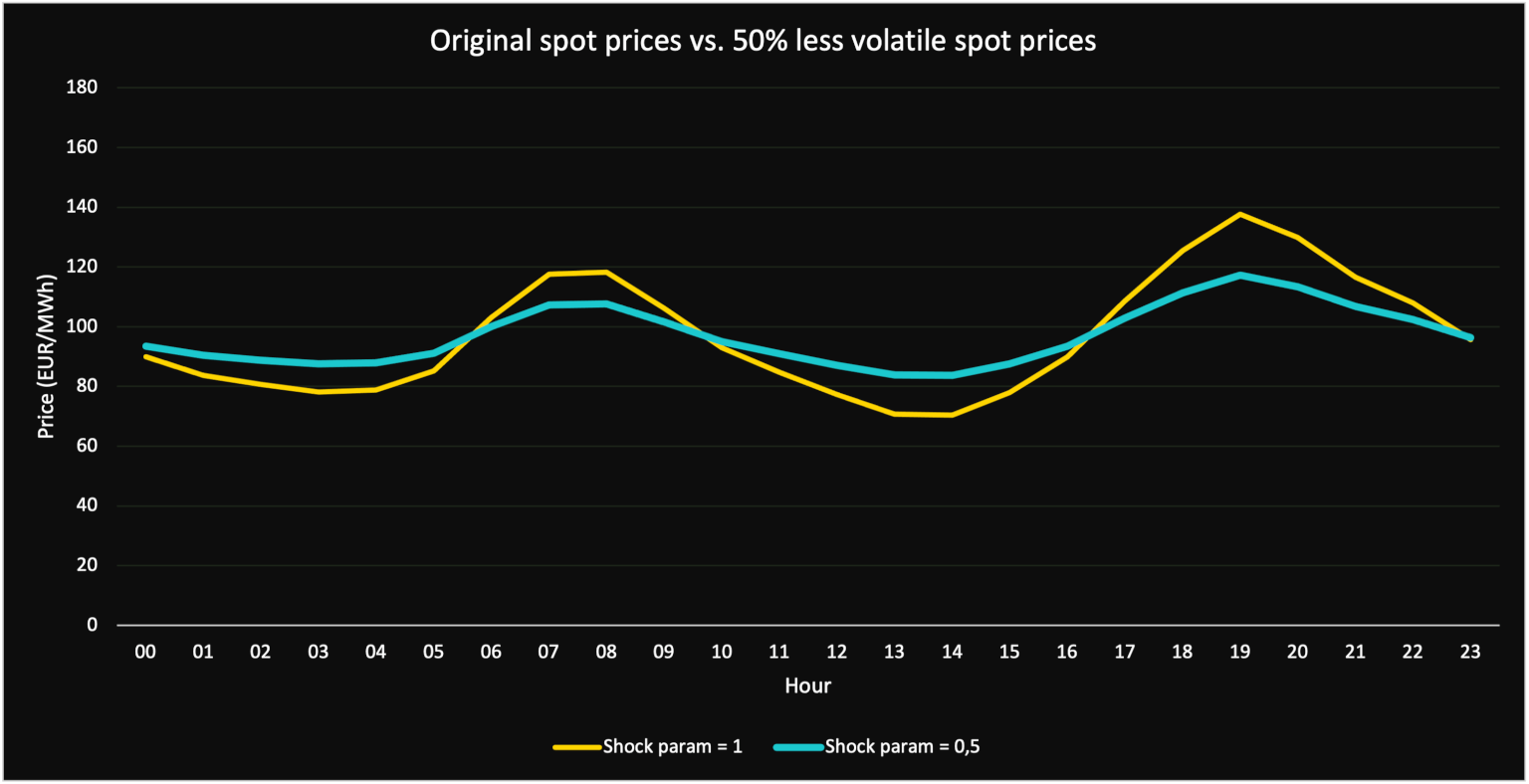

If you’ve read part II of this series, you will remember that in order to see the FlexHL shape work, we shocked the system i.e. increased and decreased the volatility based on the following formula:

New price in a given hour = (average of price for the whole year) – shock_param * (old price in a given hour – average of price for the whole year)

Doing so increased the variance in the prices and diverged them from the average as can be seen below.

If we increase volatility by 50% -

Graph 1

If we decrease volatility by 50% -

Graph 2

In this article, we continue building upon this approach and use two volatility extremes to show the revenue spread and averages for both BESS owners and traders under different contracts. For the purpose of our example, we take a BESS with 10 MW, 20MWh, and 1 cycle per day. Based on historical data (as can be seen in the FlexIndex below), we assume that the average realized trading revenues are 200 EUR/MWh per day in the high-volatility scenario and 70 EUR/MWh per day in the low-volatility scenario.

We show the revenue splits between BESS owner and trader first in the High-Volatility and then in the Low-Volatility Scenario.

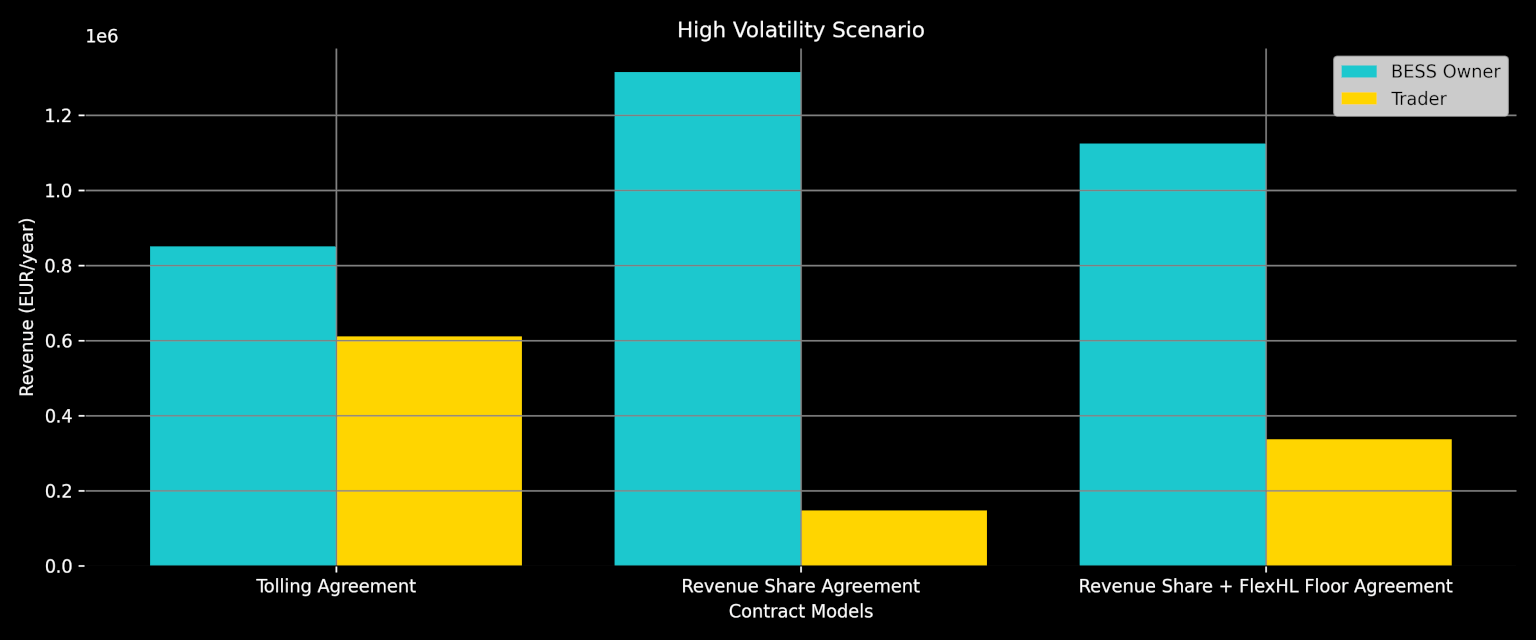

Contract Performance in a High-Volatility Scenario

Tolling Agreement

Starting with the tolling agreement in a high-volatility scenario, we further assume that the annual fixed income for the battery owner is 85,000 EUR/MW per year or a total of 850,000 EUR per year for the 10 MW BESS asset. The battery owner’s revenue is unaffected by market prices, and they take this exact amount home every year.

In contrast, the trader’s revenue comes from the annual revenue actually generated by the battery on the market by selling its flexibility and is calculated as the product of the daily energy capacity in MWh, revenue per MWh and the number of cycles in a year. This comes to 1,460,000 EUR per year, and the trader takes home the difference between this i.e. 1,460,000 EUR – 850,000 EUR = 610,000 EUR per year.

Revenue Share Agreement

In a revenue share agreement, there are no fixed incomes, and the revenue is simply calculated based on the contractually fixed split. We use a 90:10 split in favor of the BESS asset owner in this example. The overall annual revenue from the asset remains the same, i.e. 1,460,000 EUR per year. The BESS owner takes home 90% of this revenue coming to 1,314,000 EUR and the trader gets the remaining 146,000 EUR.

Revenue Share + FlexHL Floor Price Agreement

Finally, in a revenue share and FlexHL floor agreement, we make two additional assumptions. First, based on historical averages of the FlexHL shape over the last few years, we take the value of the FlexHL shape (floor) to be 85 EUR/MWh. Secondly, we modify the revenue split to 60:40. The trader takes a higher share as he only participates in the revenues that are ABOVE the guaranteed minimum. So, the revenue share for the trader and the BESS owner only starts getting calculated once the minimum revenue for the asset owner is realized. Let’s see this in practice.

The minimum guaranteed revenue for the asset owner in this case is calculated as the product of the fixed FlexHL price, the energy capacity and the number of cycles.

Minimum guaranteed revenue = 85 EUR/MWh * 20 MWh * 365 cycles

Minimum guaranteed revenue = 620,500 EUR per year

This sums up to an annual guaranteed revenue of 620,500 EUR per year. We then move on to calculating the “excess” revenue which is the difference between the total revenue (we already calculated that as 1,460,000 EUR earlier) and the guaranteed revenue for that asset, coming to a sum of 839,500 EUR annually.

Finally, we split this excess revenue to calculate the trader and BESS revenue. The trader gets 40% of the excess revenue at 335,800 EUR per year and the BESS owner gets the sum of the rest of the excess revenue and their minimum guaranteed revenue, bringing the total to 1,124,200 EUR per year.

It’s easy to see now (table below) that when prices are very volatile, the BESS asset is able to cash in the maximum returns in the contract that exposes it to the highest risk, i.e. the revenue share agreement. The addition of the floor price brings the revenue down by about 200,000 EUR but guarantees a minimum, the significance of which will be much more evident in the low-volatility scenario. Let’s take a look.

Contract Model | Volatility | Overall | BESS Revenue (EUR/year) | Trader Revenue (EUR/year) |

|---|---|---|---|---|

Tolling Agreement | High | 1,460,000 | 850,000 | 610,000 |

Revenue Share Agreement | High | 1,460,000 | 1,314,000 | 146,000 |

FlexHL + Floor Price | High | 1,460,000 | 1,124,200 | 335,800 |

Graph 3

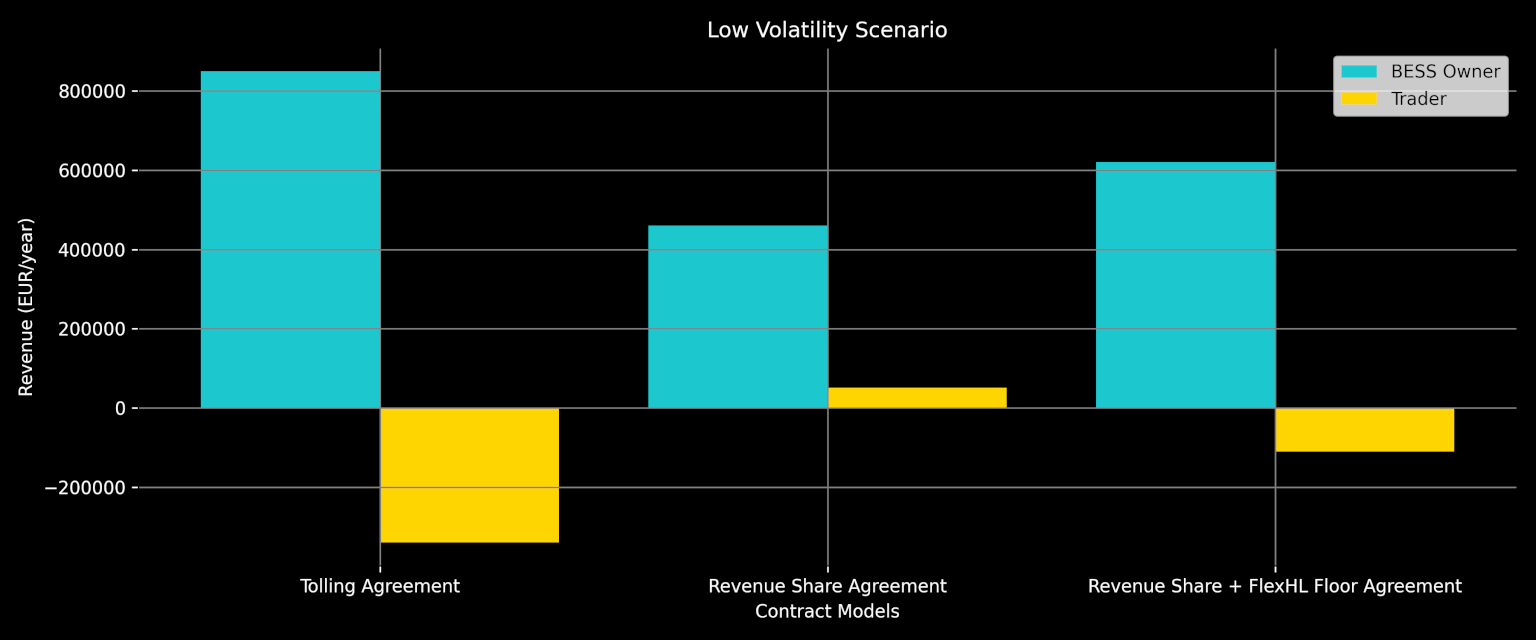

Contract Performance in a Low-Volatility Scenario

Tolling Agreement

First things first – the fixed income of a BESS asset remains the same regardless of price volatility. Therefore, in a low-volatility scenario, the BESS asset earns 850,000 EUR per year. However, the returns of the trader see a sharp drop due to a much lower assumed revenue of 70 EUR/MWh per day. In this case, the annual revenue generated from the asset equals 511,000 EUR. Subtracting the fixed rent from this value, the trader makes a revenue of -339,000 EUR per year. This revenue (loss) corroborates our point that the entire market risk is shifted to the trader in this contract (see Graph 4).

Revenue Share Agreement

Next up, in a revenue share agreement, the annual asset revenue remains the same and is split entirely between the BESS owner and the trader. The annual revenue for the BESS owner comes to 459,900 EUR/year and that for the trader to 51,100 EUR/year. This contract brings in the highest revenues for the trader in low-volatility scenarios due to risk-sharing.

Revenue Share + FlexHL Floor Price Agreement

Lastly, in a revenue share and FlexHL floor price agreement, we first calculate the guaranteed minimum revenue for the asset owner to be 620,500 EUR per year. In the next step, the excess revenue comes to a total of -109,500 EUR per year. This means that there is no excess revenue, and the trader, in fact, makes less money on the market than what they guaranteed to the asset owner, and must take the entire loss. This gives us final revenues for the BESS asset and trader of 620,500 (floor price) and -109,500 EUR per year respectively.

Now you can clearly see in the table below, that in the Revenue share and FlexHL floor agreement, while the BESS asset is able to make high revenues when prices are highly volatile, they are able to hedge and earn a minimum revenue because of the FlexHL shape even when the asset doesn’t perform well on the market.

Contract Model | Volatility | Overall | BESS Revenue (EUR/year) | Trader Revenue (EUR/year) |

|---|---|---|---|---|

Tolling Agreement | Low | 511,000 | 850,000 | -339,000 |

Revenue Share Agreement | Low | 511,000 | 459,900 | 51,100 |

FlexHL + Floor Price | Low | 511,000 | 620,500 | -109,500 |

Graph 4

And here you can find and compare revenues across both volatility scenarios in one table.

Contract Model | Volatility | Overall | BESS Revenue (EUR/year) | Trader Revenue (EUR/year) |

|---|---|---|---|---|

Tolling Agreement | High | 1,460,000 | 850,000 | 610,000 |

Tolling Agreement | Low | 511,000 | 850,000 | -339,000 |

Revenue Share Agreement | High | 1,460,000 | 1,314,000 | 146,000 |

Revenue Share Agreement | Low | 511,000 | 459,900 | 51,100 |

FlexHL + Floor Price | High | 1,460,000 | 1,124,200 | 335,800 |

FlexHL + Floor Price | Low | 511,000 | 620,500 | -109,500 |

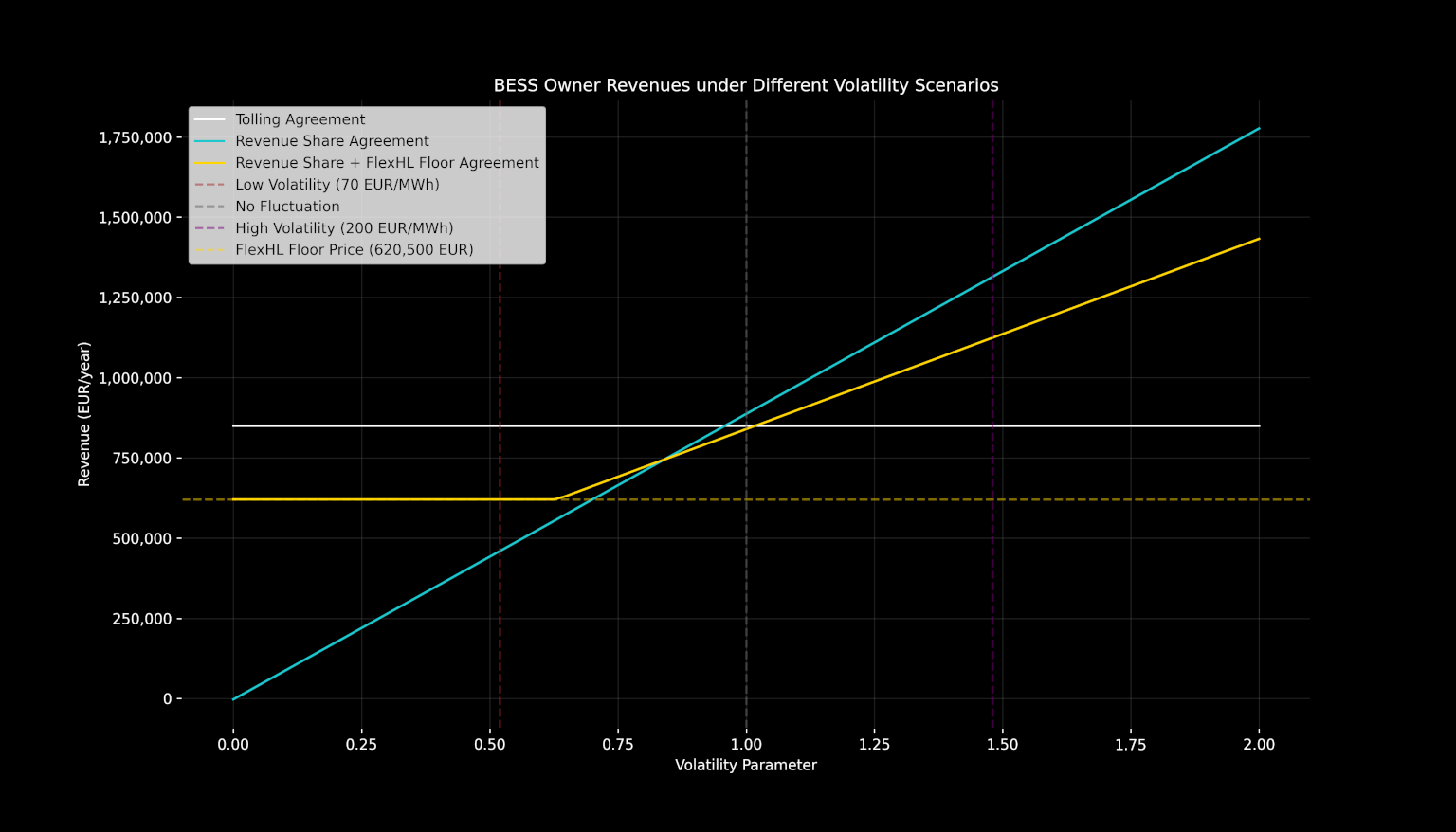

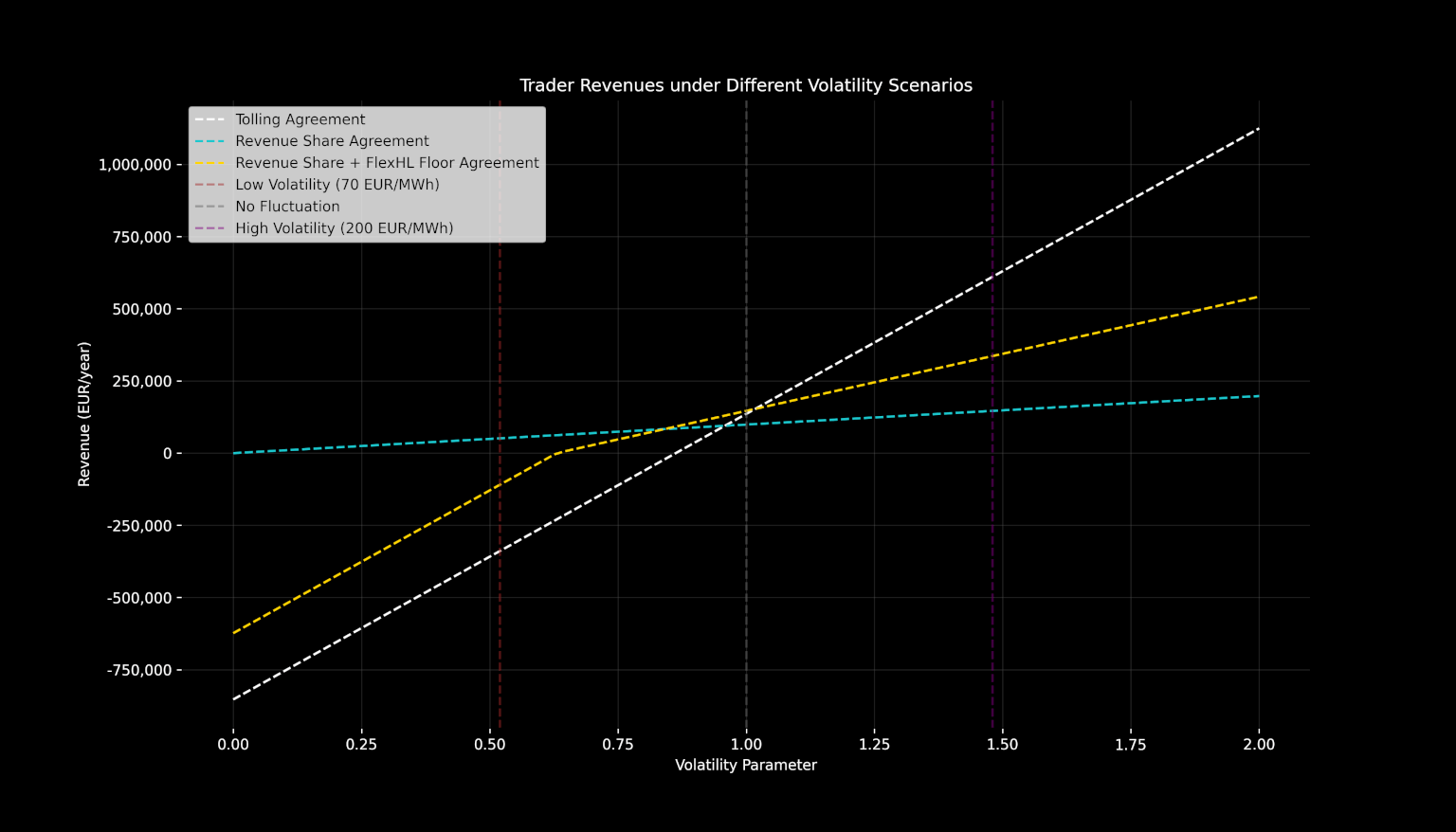

For the nerds among you, here is a conceptual graphical representation of the returns to the BESS owner (graph 5) and the trader (graph 6) as a function of volatility. It should become clear that no one contract delivers the best results in all situations but rather that there are different contract structures catering to the risk appetites of various actors.

Graph 5

Graph 6

What does the FlexHL Floor bring to the table?

If you’ve read along so far, you may be wondering why you should even go through all this hassle of revenue sharing and the FlexHL shape floor, when the good old tolling agreement is so straightforward to implement.

We believe that the FlexHL floor is a great product to use for many reasons, besides the obvious one that we’ve created it!

The FlexHL shape floor offers asset owners the best risk-return profile when selling flexibility from their battery across all volatilities. It offers a floor but continues to have a lot of upside. This allows asset owners to maximize their revenues while having a guarantee for banks that ensures financing for existing or future projects.

Secondly, it allows for a standardized market for flexibility. We talk about this extensively in part II of the series, but in essence, the FlexHL product has been created to be sold to industrials keen to hedge away their volatility risk by buying a virtual battery. In other words, Flex Power uses the FlexHL product to leverage this demand and offer long-term price security to BESS owners. This effectively creates a long-term market for flexibility that’s desperately needed to aid our decarbonization efforts.

As traders, we see our job as structuring risk for our clients, which is why we give you various contract options to monetize your assets. It is on you to find the best risk-return profile; however, we do believe that creating a market for trading flexibility should fuel investments in the BESS space.

If this has piqued your interest and you wish to know more about how you can benefit from our services, feel free to reach out to us and we’ll help you find the best solution!