In recent years, if you're involved in the power sector, you've likely come across discussions about Power Purchase Agreements (PPAs). Some consider them a cure-all for advancing the energy transition, and we, too, recognize their crucial role. However, it's essential to grasp that a PPA is essentially a contract for buying or selling power, without specifying the type.

We believe it's crucial to delve deeper into this and emphasize why those in SMEs and industrials should focus on acquiring expertise in procuring wind and solar power shapes. More importantly, there's a need to understand how to hedge against the residual risks associated with these shapes. Presently, many off-takers view these shapes through a "green" ESG lens, driven by a commendable environmental concern. Yet, there's a more pressing issue at hand.

Off-takers must familiarize themselves with handling these power shapes because, in the near future, they might constitute the majority, if not the only, available power. Technologies capable of delivering baseload or pay-as-consumed shaped power are anticipated to exit the market in the 20s and 30s. While there may still be companies providing these shapes, they will do so at a significant risk premium. No one wants to bear the burden of residual price risk.

Therefore, the emphasis on learning about purchasing wind and solar shapes isn't solely about going green. It's fundamentally about securing power at predictable and low costs while mitigating residual price risk. We're entering a world where power will be abundantly available at times and exorbitantly expensive during periods of low wind and sunlight. In this blog post, we elucidate our perspective on navigating this evolving power landscape.

Buying standardized wind and solar shapes

Let’s start with why you should care about buying wind and solar shapes. The answer is easy: They are increasingly abundant and therefore they will be relatively cheap. Wind and solar (like any other form of supply) push down prices when they are around in abundance. As these technologies (especially PV) tend to produce simultaneously, they push down each other’s prices a lot. This is a problem for producers (which we will not deal with in this article), but it is great news to you as an offtaker. The mid-level price on our PowerMatch PPA marketplace is currently around 68 EUR for solar (Cal 2024) and 79 EUR for wind with baseload at 103 EUR implying capture rates of 66% for solar and 77 % for wind. These capture rates will only fall with the increased build-out of capacity and the slow build-out of flexibility (storage) that would push these up again. So compared to baseload these are cheap (trend decreasing).

Now you can go to a wind or solar producer directly and purchase their power for a few years at a fixed price. These so-called pay-as-produced PPAs may seem charming, however they come with a few problems. First, you will have to manage all sorts of different producers in your portfolio that have different locations and produce at different times (shape variance). This means that you must engage in all sorts of forecasting activity for each idiosyncratic production profile to anticipate your positions. Also, it’s a nightmare from an operational point of view as you will have many counterparties, with many differing contracts that deliver power to you in non-standardized ways. Finding a counterpart that does the physical delivery and manage the balancing risk can be tricky and expensive. Furthermore, you have counterparty risk with many different actors, and you will need to have credit agreements with each one of them. If you are a large industrial consumer buying large amounts of power for a long time from an offshore wind farm, it may make sense to pay all the lawyers and consultants to get these deals done. We believe that these are wasted transaction costs. Furthermore, you do not have transparent price discovery because you negotiate a price with each individual producer which can be a lengthy and difficult process, especially when the underlying baseload price changes on a daily or even hourly level.

Hence, we believe that best practice will be to trade in standardized shapes that allow you to buy (and sell) standard products, whenever you want, at standardized and comparable conditions. Our enwex Wind and Solar shapes allow you to do just that: You can buy the average wind and solar production on each given day with a single counterparty that handles the physical delivery and balancing process, and you go through the credit procedure only once. Oh, and on top of this you can trade a liquid product, that transparently shows prices on screen while you can get in and out of your positions as you please. You can see, we love markets! You can read more about how our enwex based power product works here...

But enough advertising of PowerMatch, let us have a look at how this would look in practice. Let’s assume that your consumption is a flat baseload shape of 1 MW (i.e., 8760 MWh/a). Bit of a simplification, but we can do this with literally any consumption profile and our friends at trawa can help you with this process. Additionally, let’s say you purchase 1 MW of wind and 1 MW of PV. Bear in mind that enwex trades in 100 kW shapes, so 1 MW equals 10 shapes. Have a look at what your shape would look like over an average day of the year. By “residual position” we mean the difference between your consumption shape (baseload) and your purchased wind and solar production.

Graph 1: Average profile for 1 MW baseload consumption, 1 MW wind and 1 MW of solar shapes

You can see that the wind and solar shapes fail to match your consumption on an hourly basis giving you quite a bit of residual Spot price risk and the total volumes don’t match so there is some work to be done to arrive at an optimal configuration.

How to Hedge my 1 MW Baseload Consumption with a Mix of Wind and Solar Shapes

As wind and PV have much lower capacity factors or full load hours than baseload we need to do a bit of work to get the right configuration of these shapes to minimize your residual spot position. We stay with the physics here and don’t optimize this financially but rather use an optimizer that simply finds a configuration that minimizes your residual position (up and down) on a MW basis with a constraint that the total enwex volume is greater than the total consumption. We are working under the assumption that as a purchaser you want to lock in the best possible price and you wish to hedge your residual risk as much as you can. We hope this is fair. We do this with the benefit of hindsight looking at the year 2022. Obviously, this isn’t possible looking forward, but your optimal configuration will usually rely on a similar model and over the course of the year, this optimal configuration should not change substantially. You could get a higher matching rate if you just go quarter by quarter or even month by month but let’s not get too complicated at this stage and just optimize for one full year, which in our experience is a standard contract length for such an agreement.

Our optimizer arrives at an optimal configuration of 34 wind shapes and 25 solar shapes to hedge your 1 MW baseload consumption. Bear in mind that enwex shapes are traded in 100 kW (0.1 MW) instalments, as to allow market access to smaller players. So, in capacity, we bought the equivalent of 3.4 MW wind and 2.5 MW solar.

Graph 2: Average profiles with 1 MW of baseload consumption, 2.5 MW of PV and 3.4 MW of wind

This graph is analogous to graph 1 only with the optimized configuration summing the MWh in a year over a standard day. You have bought 6.535 MWh of wind and 2.232 MWh of PV (total of 8.767 MWh against a consumption volume of 8.760 MWh), which also does not perfectly match your consumption. This means that in some hours you are systematically short and in others you are systematically long. This means that you (we or any other trader would do this for you) have to buy 2.409 MWh of residual power in spot and sell 2.416 MWh in spot (we have to sell a net position of 7 MWh). We have to buy and sell, because you will sometimes be long and sometimes you will be short.

Now this is the average over the year but let’s see how this would look in extreme situations. On November 30th your wind and solar production are very low, meaning that on this day your net residual position would be -19.42 MWhs. This means that you have to buy most of your power on the spot market.

Graph 3: Production and consumption profiles on November 30th 2022

On a day such as April 1st with loads of wind and sun your net residual position would be 16.91 MWhs. This means you would have to sell a lot of power on the spot market. We will get to financial risk in a moment, in case you’re getting impatient with the physical views.

Graph 4: Production and consumption profiles on April 1st 2022

Given that wind and PV shapes will never perfectly match your consumption, open residual position will be inevitable, so let us examine how this affects you financially.

How do my Financial Returns look like if I hedge with enwex at Fair Prices?

Now let’s turn to the financial side of this. Looking back at 2022 we can do something that obviously you cannot do looking forward: price each shape at a perfect “fair price”. This means that we simply multiply the MWhs produced in each hour with the respective hourly spot price and pretend that we fixed prices at an average level of this before the start of the year. This is a bit of a loopy exercise, as the whole point of a hedge is the fact that you do not know how prices develop, but it is a good starting point to carry on with this analysis later. Bear with us, we will add complexity as we go along.

The fair price for a baseload consumption profile for 2022 was exactly the average price of all hours in Spot namely 235.45 EUR/MWhs. For wind and PV, we simply multiply hourly production with the hourly Spot prices and then get an average value of 162.52 EUR/MWh for wind and 226.50 EUR/MWhs for PV. These wind and solar values (i.e. so called capture rates) tend to be lower than average prices, as prices are lower when renewable supply is higher. Now bear in mind that 2022 was a crazy year in terms of price volatility and the capture rates of wind and solar are not representative for future years, however this is not relevant for our example.

Let us look at how our average returns would have looked over the year referring back to Graph 2, only that now we are looking at financial flows rather than power flows. We purchased 6.535 MWhs of wind for a fixed price of 162.52 EUR/MWh and a total expenditure of 1,062,132 EURs. We purchased 2.232 MWhs of PV at a fixed price of 226.50 EUR/MWh and a total expenditure of 505,600EUR. In order to flatten our residual position, we bought 2.409 MWh in Day Ahead at an average price of 312.15 EUR/MWh and sold 2.416 MWh at 106.44 EUR/MWh. It is normal in this setup that we buy at high prices and sell at low prices as the availability of renewables is a key driver of prices. Managing this residual position results in a cost of 494,776 EUR. Summing up all of these costs we have a total expenditure of 2,062,508 EUR for 8760 MWhs. This gives us an average price of 235.45 EUR/MWhs. Does this price seem familiar to you? Well, it is EXACTLY the average price of baseload for 2022 at 235.45 EUR/MWh.

Graph 5: Financial expenditures of the enwex hedge position and a baseload hedge at fair prices

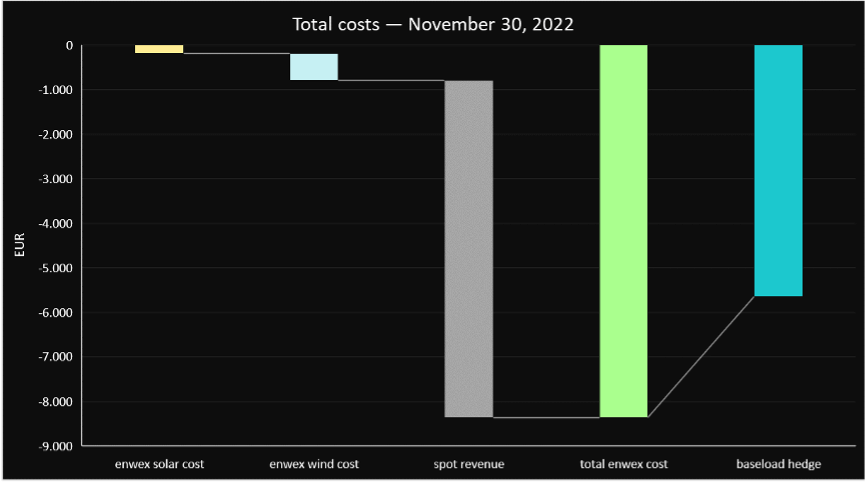

How can this be? The reason for this is that we fixed prices at exactly the fair value for the year, and as long as we do this, the hedge has no influence whatsoever. However, if we look at an individual day, such as Nov 30th, we can see the hedge in place. For a day with low renewables such as Nov 30th, we bought wind and solar at cheap prices through the enwex shapes, however not enough, so on this day we end up with an average price per MWh of 348.99 EUR, as we need to purchase lots of power at high prices.

Graph 6: Financial expenditures of the enwex hedge position and a baseload hedge at fair prices on Nov 30

On a day like April 1th with lots of and wind and solar we are long and get to sell a lot of power that we bought through enwex shapes, earning extra revenues on the spot market. This decreases our daily average price to 167.67 EUR/MWh.

Graph 7: Financial expenditures of the enwex hedge position and a baseload hedge at fair prices on Apr 1st

While the hedge “bites” on a daily view it has no impact on a yearly view, as we fixed prices at fair value on a yearly level. Now in reality, as I mentioned before, the whole point to hedge your consumption is that you do not know how prices turn out. Therefore, we need to price-shock our system to show how this hedge could work in a more realistic situation.

What are my Annual Returns if I increase Spot Prices by 50%?

In the old world of energy a price shock of 50% might have seemed excessive but I think in current times, this can be considered a reasonable scenario for any power purchaser. Hence, we simply increase all spot prices by 50% having hedged our consumption at fair prices BEFORE the price shock occurred. Let us assume 3 scenarios. First scenario is unhedged, where we simply buy all the power on the spot market. The 2nd scenario is a baseload (or here: full pay-as-consumed) hedge of our consumption and the 3rd scenario is our optimally configured enwex hedge.

No Hedge, all Spot

This case isn’t very complicated. We buy all our power in spot and prices have increased 50%. Therefore, we spend 3,093,762 EUR on power at an average price of 353.17 EUR/MWh. Simply 50% higher. This is exactly the scenario a purchaser wants to avoid and the reason she hedges in the first place.

“Perfect Hedge”, pay-as-consumed

Also, no need for complicated math here: You fixed your price for your exact profile so by definition you carry 0 risk. Your expenditure stays the same at 2,062,508 EUR and 235.45 EUR/MWh. Bear in mind that our argument is that this won’t be available in the future without you paying a massive risk premium, however we are in a rosy model world so let’s keep it as an example.

Enwex Hedge with Wind and Solar Shapes

With the enwex hedge, your expenditure on wind and solar is the same as above as you fixed those prices. However, your residual position has become more expensive and you now spend 742,165 EUR. Why is this the case: As mentioned previously, wind and solar tend to drive down prices, so with an enwex hedge in high price scenario, you will tend to be short, when prices are high. You can read in part 2 of this blog how to hedge this risk with the FlexHL shape, but for now we have to deal with it. You can see that your price level has increased a bit, however your prices are still lower than in the spot scenario, as you have fixed prices for your wind and solar production. While overall prices increased by 50% your prices only increased to 263.69 EUR/MWh or by 12.0%. So, your hedge worked, but it is definitely imperfect.

Graph 8: Expenditures with enwex hedge vs baseload hedge under a 50% price increase

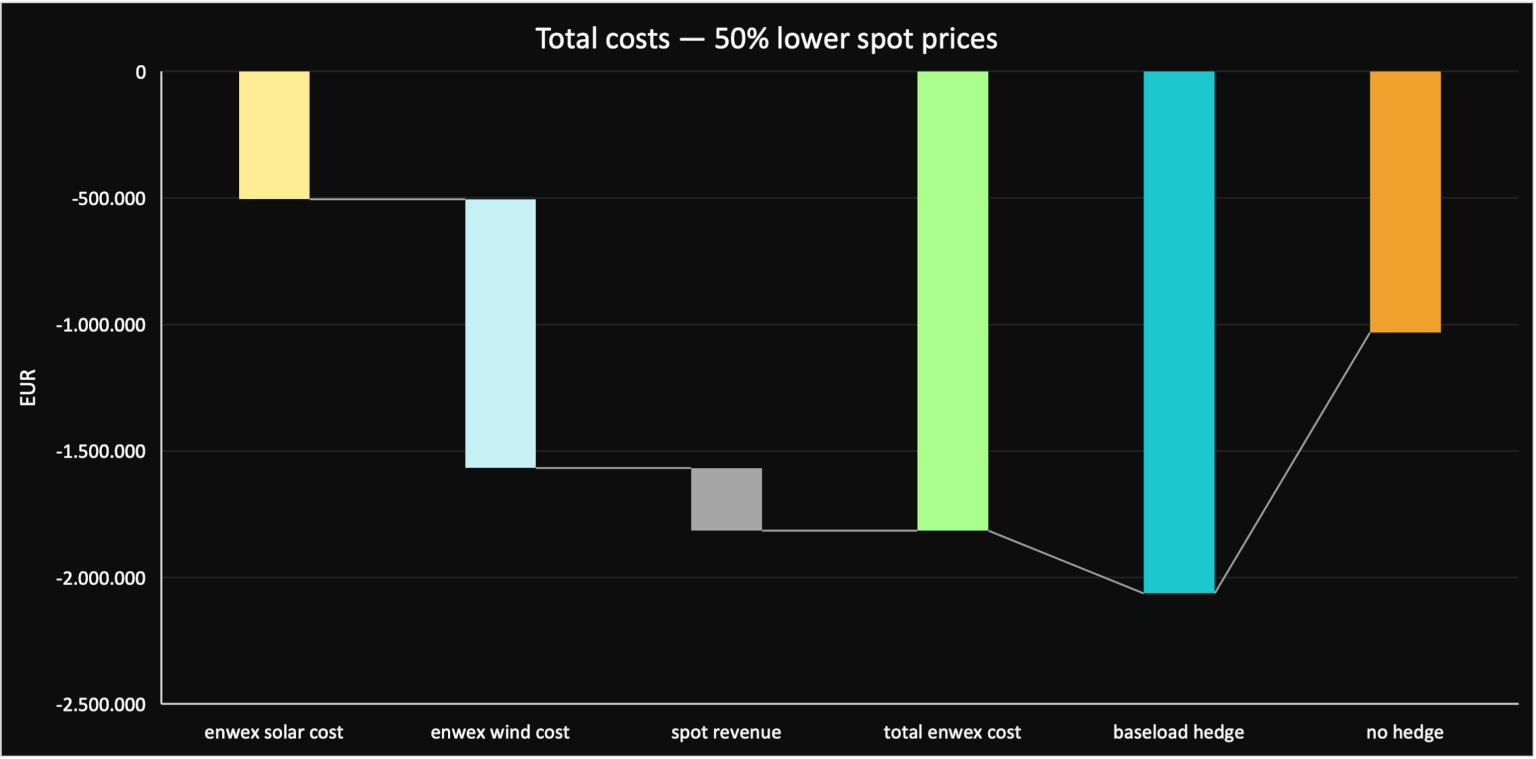

What are my Annual Returns if I decrease Spot Prices by 50%?

Now let’s do the same exercise, however looking at returns when prices decrease by 50% compared to the initial price level.

No Hedge, all Spot

Again, nothing surprising here, as you simply pay spot prices which have decreased by 50%. Your expenses are now at 1,031,254 EUR and your average price at 117.72 EUR/MWh. This is the best outcome now, as you fully benefit from falling prices.

Perfect Hedge, pay-as-consumed

This is the same case above, as you are perfectly hedged and you get exactly the same returns of 2,062,508 EUR and 235.45 EUR/MWh. However, this is now your worst outcome, as you do not benefit at all from falling prices.

Enwex Hedge with Wind and Solar Shapes

The enwex hedge gets you a mixed outcome, as before. You still pay the same amount for the wind and PV production as you fixed prices here. However, you now only spend 247,388 EUR or for your residual position. Therefore, your open residual position has become a lot cheaper, and you now benefit from the lower spot prices. In total you are now spending 1,815,120 EUR and 207.21 EUR/MWh. Compared to the base case your price has decreased by 12 %. So, this outcome is now better than in the perfectly hedged case. The intuition should be clear by now. As a hedge is set against rising prices, an imperfect hedge will give you a better outcome than a perfectly hedged case whenever prices fall.

Graph 7: Expenditures with enwex hedge vs baseload hedge under a 50% price decrease

Why would I Hedge with Enwex instead of Buying Baseload?

If I was a purchaser and read to this point, I would ask myself why in the world I would ever go through the trouble of buying these wind and solar shapes instead of just buying a baseload or a pay-as-consumed contract? The answer is twofold: First, in the future it will be difficult to find anyone who can sell you baseload or pay-as-consumed because the power plants to back this up simply will not be around. Therefore, the actor selling you this shape will have to carry the residual risk that you don’t like and this will be costly. This brings us to the second point: enwex shapes will be comparatively cheap because wind and solar are abundant. In addition they are “green” in case you want guarantees of origin to go with your consumption. Cheaper and green sounds good, no? So here is the catch: The problem with residual risk i.e. the price of power, when wind and solar are not producing is that no one really knows how high prices can and will materialize in these situations. We believe that this risk should best be carried by the actor that can best influence it. And that is you, the consumer. You have the power to control your consumption when prices are high and either reduce it or find flexible processes that adapt to power prices. If you cannot do either of these things, you can think about building storage that takes power in cheap hours and delivers it to you when prices are expensive thereby reducing residual price risk or even allows you to benefit from price volatility. Or could there even be a third way where you can buy a hedge for price volatility? Keep holding onto your seat for our next article where we will introduce our FlexHL product that lets you do exactly this, without having to build a battery yourself. But more on that later.

For now, we sum this article up:

The future of purchasing power professionally requires an understanding of the value of wind and solar shapes. These shapes will be cheap (and green) and we strive to build a market with standardized products that allows you to easily deal in these shapes in order to (imperfectly) hedge your long term price exposure. We and others can help you along this process. If you want to stick to pay-as-consumed or baseload shapes you can do this and be stuck with high prices while the market changes around you. If you wish to learn more about hedging future price risk in a renewables world stick around for part 2, where we will explain how you can add your own “virtual” battery to your energy procurement strategy.